Can't find the story I read last night, but either way looks like something might eventually happen at one of the more unusual ruins in the Detroit area.

Shu, lost touch with Detroit, but no matter what they dream about you need people to buy/rent and everyone seems clueless to the fact....they talk about stuff like this in my area all the time but we lost 13,000 people during the recession, think Detroit lost 23,000….are they coming back? Even if they do we’ve got their old house still vacant, have to sell that first. Must be something I’m missing.

Carrera, I think this is in the suburbs of Detroit not the city, I think the metro area has not shrunk quite as drastically as the city proper.

I think that this investment seemed foolish even in the 2008 market but there will always be some people who will love the city and try to keep it going, but it can never be what it was and recovery yet alone growth of any lost population is not possible with a failing school system.

Miles, I'm not that smart, but when I learned during the recession that it's legal for someone to "Invest Short" (Bet) on something that they think will fail and profit from it when it does, that's when my money hit my mattress. In other words they want to fund failure because they jettison the debt to some foreign schmuck then hit the “short” window. Bet there's a boatload of bankers lining up on this one.

There are some potentially big developments going on in areas of Detroit that may have positive effect. Additionally I think the city is finding new footing in the markets of the country.

It's a slow road to recover for the D, but it seems to be moving in the right direction.

Like Detroit, big money in Detroit, more than people realize. This project is a little different though, it's a "New-Town" of sorts requiring population & families, at least that was the original plan.

Detroit has benn trying to develop it's way out of total economic collapse since Clinton signed NAFTA. Imagining that it's going to work now is stupidity. There is a very different game afoot.

Carerra, shorting has reached the level of independent nations, Greece is the best example. 90% of every bailout goes to pay foreign 'investors' high interest. Watch what happens when they dump the Euro and the Greek debt banks claim as an asset is erased. Or conversely, watch what happens if they don't ... remember how Hitler came to power.

Guess i should have specified that the reason I find the "ruins" above so interesting is that they are in such a wealthy area.

Bloomfield Twp, West Bloomfield, and Birmingham, are probably the richest municipalities in michigan. Bloomfield Twp, where this project is located, is apparently the 10th most expensive suburb in the US. If you read the second link, the project history, it is located right on the border of Pontiac. A city in worse shape than detroit and with no raison d'etre that i can think of. Household incomes go from 150k to 30k real fast around here. Home values are well over 2 mill to 15k within a mile of each other.

Miles - I hope your cynicism is misguided since i live about 2 miles away. no idea what the dev. are thinking, but tearing down the parking decks would be a nice start.

Shu, I have a long history in Detroit and was there when this development surfaced and had a screwy look on my face then and now about it. Love Birmingham, everybody does and that's what they thought they were replicating, but it's an ADD, meaning they were/are adding rooftops. Birmingham should be replicated and I can think of about six places in greater Detroit where it could be, but those would be principally rehab of existing rooftops.... if they add rooftops then they need to add people and you need about 20,000 to break even at my count.

See this stuff all the time... my town has a prime piece of bare land that they would give me for nothing if I developed it, would also pay for my infrastructure, tax breaks and with that I could get financing, but if I did it, it would sit vacant, then what?

Kinda back to Miles, I smell a rat too, we're heading right back to 2008....when you see the banks start funding this kind of stuff that means somebody is planning to sell short, with full knowledge of failure. These guys figured out how to get paid twice.... thought that was my game:)

Whoa, shuellmi, that second article describes a huge clusterfuck!! Goodness, it's diabolical.

The annexation issue was a divisive one, automatically casting the township as the well-heeled area denying its poor neighbor its best chance for collecting hefty tax revenue. The takeover also led to another mini-scandal, in which Cotton and the Michigan State Police alleged that employees of Schubiner’s Harbor Cos. gave free rent to township residents, some of whom the State Police said were recruited to move into the target area, register to vote, and vote “yes” for the annexation into Pontiac.

Sometimes I'm embarrassed to be associated with the construction industry.

shuellmi - agreed with miles and carrera - this thing seems really fishy - yeah there are a few 2+mil properties in the area (although - usually giant houses on massive lots overlooking one of the lakes) - but if you look at current condo and more typ single family sales for the area it just isn't close to where it needs to be to justify demand for this project... and the trends aren't heading in the developers' favor either...

Shu, don't think interest rates should be a concern in short term, still low, I figured out how to thrive at 16%. I also find it interesting in our business when things are bad national construction spending only falls 2 digits (10.7% in last recession)….there’s still 89.3% of something going on somewhere.

like i said carrera, i don't work much with residential so i can't comment on that.

it costs money to fire half your staff. if you're a mortgage company, it costs money to fire your whole staff. so people pay architects to move their smaller staff into smaller offices.

also saw a couple kitchen/bath remodeler type contractors try their hand at simple commercial or retail remodels (to accommodate the smaller staff sizes). it's hard to communicate with those guys how one goes about meeting code and getting a permit through the city and all that. they could charge less because they had no idea what they were doing.

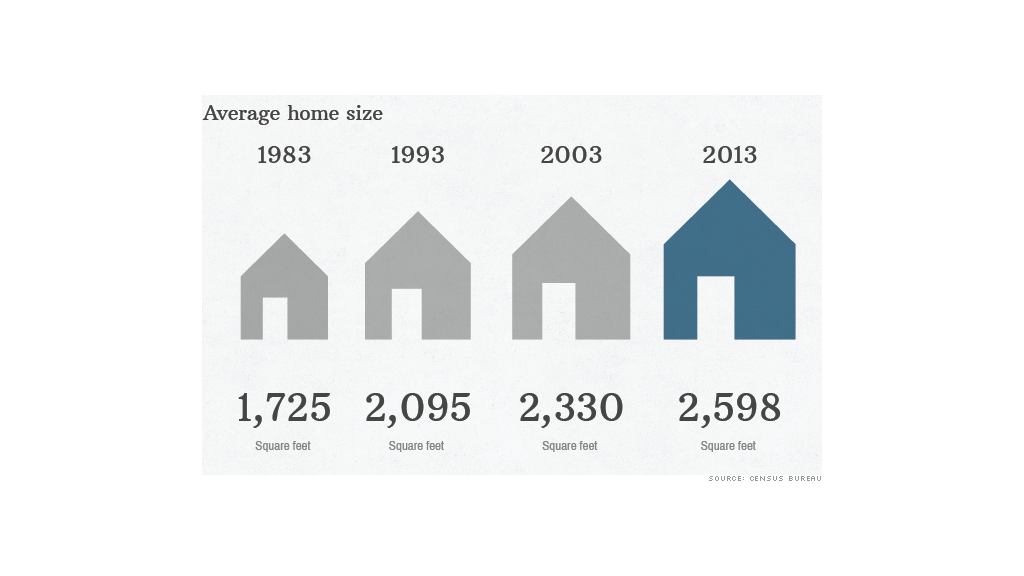

carrera- those numbers are only for new single family homes - single family starts are much much lower than they used to be (we're still only at maybe 1/4 the level of 2005), and the size increase mostly reflects older and wealthier people buying up. Younger and less well-off people are mostly opting for multi-family or staying out of the market entirely.

multi-family currently makes up about 2/3rds of all new units being created in the US - about 3 times as much as 2005.

Toast – that’s just average square footage of single family homes built in U.S. from the US Census, nothing analytical, thought Curt meant downsizing in that regard. What he meant was business downsizing that is/was creating new construction opportunities and I guess it does…but a 10,000 square foot tenant going belly up and starting over in a strip-mall doesn’t help everybody.

As to your thoughts, I’ve read the same patterns, I wonder how all that’s going to shake out. Demographics are changing, but rents are rising because of demand and the big money is betting the single family market will come back for the same reasons people prefer personal cars.

the auto industry is in trouble - over half of all car loans in US are subprime - meaning the people who are buying cars can't really afford them - defaults are on the rise... global car market is weak - china is slowing down... Ford has proposed making bicycles for the european market. I doubt single family is going to make a comeback. it'll be slow growth in some markets - other markets it's all multi-family.

Mar 11, 15 10:48 pm ·

·

Those figures between 2003 and 2013 can be largely reflected in the houses designed and built in 2003-2007/2008 as there was little housing built during the recession itself. 2003-2007 reflects alot of grossly oversized McMansions being built in the 3000-4000 sq.ft. sizes when volume of houses are compared to what was already built and averaged out it raised the average house size. While 2007-2013 would mark downsizing but those won't show on the census data and then there isn't accurate data submitted. Often old houses had unused areas like unfinished lofts but those spaces are remodeled and hence expanded the liveable floor space which is what is often reported.

I think census data is fundamentally flawed.

However, I doubt the average liveable area necessarily shrunk even though more and more people are downsizing but that is countered by the fewer that will be ever more expansive houses.

Who knows... In the long run people will continue to build larger and larger houses because an average individual with all his/her collected crap (and yes.... old computers and tech gadgets that is replaced with new gadgets) is the big dominant reason.

It is harder to just get rid of the tech stuff because people have to pay money to get rid of their old computers. They can't just put it on the street so people just store them.

Our tech culture is a dominant reality of our expansive sq.ft needs and that's for all that storage of stuff we just can't rid of because it is made harder to get rid of. People would get rid of stuff it it could be free and picked up by the garbage collector but they don't do that. So, instead of the stuff going to the dumps, it gets crammed into every cranny hole in the homes. Just a reality. It's not just tech stuff, either.

Richard - Funny, a number of years ago all the area municipalities put restrictions on garbage pick-up's (quantity, size, weight, material)... at the same time recycling got popular so there are recycling drop off dumpsters around town (dumpsters in a row) and every time I go to drop off my recycling there is all manner of trash strewn about.... point is they can stop picking it up at the curb but then they end up with it anyway at the recycling center... brilliant.

In measuring "downsizing" there are probably too many factors to consider...I at one time downsized to a condo then turned around and built a vacation cottage up north.... how would that be factored? I hear what Toast is saying but that doesn't square with what I'm seeing.

Mar 12, 15 10:30 am ·

·

Although there is now recycling, alot of stuff is never collected at the street such as big bulky items like big furniture, old computer and technology, etc.

All the added reasons for not collecting which will never find its way to the trash or recycling because it won't be collected.

During the recession, downsizing wasn't a voluntary choice, the banks stole their homes and kicked them out and many were left with nothing or a considerably less than the value of their homes. Nothing particularly nice.

All those subprime cars loans are (surprise!) being packaged and resold as high interest investments, with ratings that do not reflect their insecurity. You can be sure that the big investment firms that are selling them are also shorting them.

Mar 12, 15 1:50 pm ·

·

Block this user

Are you sure you want to block this user and hide all related comments throughout the site?

Archinect

This is your first comment on Archinect. Your comment will be visible once approved.

Detroit Ruins

Can't find the story I read last night, but either way looks like something might eventually happen at one of the more unusual ruins in the Detroit area.

http://www.theoaklandpress.com/general-news/20150219/rift-visible-over-approach-to-bloomfield-park-redevelopment

Current state and history:

http://www.dbusiness.com/September-October-2011/Modern-Ruin/#.VP8eyvnF9Bk

Shu, lost touch with Detroit, but no matter what they dream about you need people to buy/rent and everyone seems clueless to the fact....they talk about stuff like this in my area all the time but we lost 13,000 people during the recession, think Detroit lost 23,000….are they coming back? Even if they do we’ve got their old house still vacant, have to sell that first. Must be something I’m missing.

Carrera, I think this is in the suburbs of Detroit not the city, I think the metro area has not shrunk quite as drastically as the city proper.

I think that this investment seemed foolish even in the 2008 market but there will always be some people who will love the city and try to keep it going, but it can never be what it was and recovery yet alone growth of any lost population is not possible with a failing school system.

Over and OUT

Peter N

$500 million in retail and residential development - who's going to live and shop there? There is a housing surplus.

Another scheme by vulture capitalists.

Peter, maybe this will clear things up - a planners nightmare. Note Detroit, it's Metro.

Miles - keep an eye on this one, if the banks fund this thing get your money under your mattress before nightfall.

Carerra, the best way to rob a bank is to own one.

Miles, I'm not that smart, but when I learned during the recession that it's legal for someone to "Invest Short" (Bet) on something that they think will fail and profit from it when it does, that's when my money hit my mattress. In other words they want to fund failure because they jettison the debt to some foreign schmuck then hit the “short” window. Bet there's a boatload of bankers lining up on this one.

There are some potentially big developments going on in areas of Detroit that may have positive effect. Additionally I think the city is finding new footing in the markets of the country.

It's a slow road to recover for the D, but it seems to be moving in the right direction.

Like Detroit, big money in Detroit, more than people realize. This project is a little different though, it's a "New-Town" of sorts requiring population & families, at least that was the original plan.

Detroit has benn trying to develop it's way out of total economic collapse since Clinton signed NAFTA. Imagining that it's going to work now is stupidity. There is a very different game afoot.

Carerra, shorting has reached the level of independent nations, Greece is the best example. 90% of every bailout goes to pay foreign 'investors' high interest. Watch what happens when they dump the Euro and the Greek debt banks claim as an asset is erased. Or conversely, watch what happens if they don't ... remember how Hitler came to power.

Guess i should have specified that the reason I find the "ruins" above so interesting is that they are in such a wealthy area.

Bloomfield Twp, West Bloomfield, and Birmingham, are probably the richest municipalities in michigan. Bloomfield Twp, where this project is located, is apparently the 10th most expensive suburb in the US. If you read the second link, the project history, it is located right on the border of Pontiac. A city in worse shape than detroit and with no raison d'etre that i can think of. Household incomes go from 150k to 30k real fast around here. Home values are well over 2 mill to 15k within a mile of each other.

Miles - I hope your cynicism is misguided since i live about 2 miles away. no idea what the dev. are thinking, but tearing down the parking decks would be a nice start.

The power of accurate observation is commonly called cynicism by those who have not got it.

Shu, I have a long history in Detroit and was there when this development surfaced and had a screwy look on my face then and now about it. Love Birmingham, everybody does and that's what they thought they were replicating, but it's an ADD, meaning they were/are adding rooftops. Birmingham should be replicated and I can think of about six places in greater Detroit where it could be, but those would be principally rehab of existing rooftops.... if they add rooftops then they need to add people and you need about 20,000 to break even at my count.

See this stuff all the time... my town has a prime piece of bare land that they would give me for nothing if I developed it, would also pay for my infrastructure, tax breaks and with that I could get financing, but if I did it, it would sit vacant, then what?

Kinda back to Miles, I smell a rat too, we're heading right back to 2008....when you see the banks start funding this kind of stuff that means somebody is planning to sell short, with full knowledge of failure. These guys figured out how to get paid twice.... thought that was my game:)

Whoa, shuellmi, that second article describes a huge clusterfuck!! Goodness, it's diabolical.

The annexation issue was a divisive one, automatically casting the township as the well-heeled area denying its poor neighbor its best chance for collecting hefty tax revenue. The takeover also led to another mini-scandal, in which Cotton and the Michigan State Police alleged that employees of Schubiner’s Harbor Cos. gave free rent to township residents, some of whom the State Police said were recruited to move into the target area, register to vote, and vote “yes” for the annexation into Pontiac.

Sometimes I'm embarrassed to be associated with the construction industry.

shuellmi - agreed with miles and carrera - this thing seems really fishy - yeah there are a few 2+mil properties in the area (although - usually giant houses on massive lots overlooking one of the lakes) - but if you look at current condo and more typ single family sales for the area it just isn't close to where it needs to be to justify demand for this project... and the trends aren't heading in the developers' favor either...

you guys are really raining on my parade - not that i can really disagree

One of the reasons I wanted to switch jobs is fear that any increase in interest rates would severely reduce even the super high end retail sector

Shu, don't think interest rates should be a concern in short term, still low, I figured out how to thrive at 16%. I also find it interesting in our business when things are bad national construction spending only falls 2 digits (10.7% in last recession)….there’s still 89.3% of something going on somewhere.

haven't looked to verify those numbers - but if construction spending fell only 10% why architecture employment fall almost 1/3rd?

just seems like the decline in employment is out of scale to the spending decline

i'm not familiar with residential carrera, but i saw a lot of construction related to downsizing during the recession.

Shu - I would amend Mr. McGuire’s advice to Benjamin in The Graduate to read:

Mr. McGuire: I just want to say one word to you. Just one word.

Benjamin: Yes, sir.

Mr. McGuire: Are you listening?

Benjamin: Yes, I am.

Mr. McGuire: ENGINEERING

Curt - Downsizing what?

like i said carrera, i don't work much with residential so i can't comment on that.

it costs money to fire half your staff. if you're a mortgage company, it costs money to fire your whole staff. so people pay architects to move their smaller staff into smaller offices.

also saw a couple kitchen/bath remodeler type contractors try their hand at simple commercial or retail remodels (to accommodate the smaller staff sizes). it's hard to communicate with those guys how one goes about meeting code and getting a permit through the city and all that. they could charge less because they had no idea what they were doing.

It's always the guy who doesn’t know what he’s looking at that ends up being the low bid….country thrives on that.

carrera- those numbers are only for new single family homes - single family starts are much much lower than they used to be (we're still only at maybe 1/4 the level of 2005), and the size increase mostly reflects older and wealthier people buying up. Younger and less well-off people are mostly opting for multi-family or staying out of the market entirely.

multi-family currently makes up about 2/3rds of all new units being created in the US - about 3 times as much as 2005.

Toast – that’s just average square footage of single family homes built in U.S. from the US Census, nothing analytical, thought Curt meant downsizing in that regard. What he meant was business downsizing that is/was creating new construction opportunities and I guess it does…but a 10,000 square foot tenant going belly up and starting over in a strip-mall doesn’t help everybody.

As to your thoughts, I’ve read the same patterns, I wonder how all that’s going to shake out. Demographics are changing, but rents are rising because of demand and the big money is betting the single family market will come back for the same reasons people prefer personal cars.

the auto industry is in trouble - over half of all car loans in US are subprime - meaning the people who are buying cars can't really afford them - defaults are on the rise... global car market is weak - china is slowing down... Ford has proposed making bicycles for the european market. I doubt single family is going to make a comeback. it'll be slow growth in some markets - other markets it's all multi-family.

Those figures between 2003 and 2013 can be largely reflected in the houses designed and built in 2003-2007/2008 as there was little housing built during the recession itself. 2003-2007 reflects alot of grossly oversized McMansions being built in the 3000-4000 sq.ft. sizes when volume of houses are compared to what was already built and averaged out it raised the average house size. While 2007-2013 would mark downsizing but those won't show on the census data and then there isn't accurate data submitted. Often old houses had unused areas like unfinished lofts but those spaces are remodeled and hence expanded the liveable floor space which is what is often reported.

I think census data is fundamentally flawed.

However, I doubt the average liveable area necessarily shrunk even though more and more people are downsizing but that is countered by the fewer that will be ever more expansive houses.

Who knows... In the long run people will continue to build larger and larger houses because an average individual with all his/her collected crap (and yes.... old computers and tech gadgets that is replaced with new gadgets) is the big dominant reason.

It is harder to just get rid of the tech stuff because people have to pay money to get rid of their old computers. They can't just put it on the street so people just store them.

Our tech culture is a dominant reality of our expansive sq.ft needs and that's for all that storage of stuff we just can't rid of because it is made harder to get rid of. People would get rid of stuff it it could be free and picked up by the garbage collector but they don't do that. So, instead of the stuff going to the dumps, it gets crammed into every cranny hole in the homes. Just a reality. It's not just tech stuff, either.

Richard - Funny, a number of years ago all the area municipalities put restrictions on garbage pick-up's (quantity, size, weight, material)... at the same time recycling got popular so there are recycling drop off dumpsters around town (dumpsters in a row) and every time I go to drop off my recycling there is all manner of trash strewn about.... point is they can stop picking it up at the curb but then they end up with it anyway at the recycling center... brilliant.

In measuring "downsizing" there are probably too many factors to consider...I at one time downsized to a condo then turned around and built a vacation cottage up north.... how would that be factored? I hear what Toast is saying but that doesn't square with what I'm seeing.

Although there is now recycling, alot of stuff is never collected at the street such as big bulky items like big furniture, old computer and technology, etc.

All the added reasons for not collecting which will never find its way to the trash or recycling because it won't be collected.

During the recession, downsizing wasn't a voluntary choice, the banks stole their homes and kicked them out and many were left with nothing or a considerably less than the value of their homes. Nothing particularly nice.

All those subprime cars loans are (surprise!) being packaged and resold as high interest investments, with ratings that do not reflect their insecurity. You can be sure that the big investment firms that are selling them are also shorting them.

Block this user

Are you sure you want to block this user and hide all related comments throughout the site?

Archinect

This is your first comment on Archinect. Your comment will be visible once approved.