Architecture is stuck between past and future -- years of anticipatory planning designs a structure that, once constructed, is stuck referring to all that came before. A building can't actually predict the future, although it seems like the best ones always run the risk of trying. Jonathan Massey's essay "Risk Design", perceives architecture as a mediator and optimizer of risks, using Foster + Partner's fantastically phallic skyliner in London's financial district, known as the "Gherkin", as a case study. Massey turns the Gherkin inside out, mapping details of its design onto local and global concerns such as terrorism and global warming, in an attempt to understand how architecture negotiates risks, and whether it succeeds. That the Gherkin's major tenant, Swiss Re, is a reinsurance company adds no small irony to his study.

Archinect is proud to feature Massey's piece in full, in line with our ongoing investigation of architectural accountability. "Risk Design" was originally published on Aggregate, the online publication platform for the Aggregate Architectural History Collaborative.

Jonathan Massey's "Risk Design":

Back the Bid. Leap for London. Make Britain Proud. Emblazoned across photomontages of oversized athletes jumping over, diving off, and shooting for architectural landmarks old and new, these slogans appeared in 2004 on posters encouraging Londoners to support the city’s bid to host the 2012 Olympic Games. Featured twice in the series of six posters—along with Buckingham Palace, Nelson’s Column, the Tower Bridge, the London Eye, and the Thames Barrier—was 30 St Mary Axe, the office tower known colloquially as the Gherkin for its resemblance to a pickle, or as the Swiss Re building, after the Zurich-based reinsurance company that commissioned the building and remains its major tenant.

One poster shows the upper half of the Gherkin standing alone against a clear sky. A gymnast vaults above the building, using its smoothly rounded apex as a pommel. The contrasting blues of his uniform echo those of the building’s glazing, while the higher of his legs aligns with one of the spirals that animate the otherwise crisp and symmetrical tower. Constructing affinities between body and building even as it captured attention through a dramatic juxtaposition of scales, the poster associated British athleticism and architecture as complementary manifestations of daring and skill. In representing Games-hosting as a leap akin to vaulting over the Gherkin, it also imagined public investment as the running of a risk. By figuring the building’s dynamic equipoise as support for the gymnast’s virtuosity, it enlisted the Gherkin as evidence that London possessed the expertise and daring to handle that risk—to manage the complex investments and construction projects in infrastructure, architecture, and landscape needed to host an Olympic games.

A forty-one story cylinder that tapers inward at its base and its top, where it peaks in a rounded apex, the Gherkin has been compared to many objects of similar shape, including a pine cone, a bullet, a stubby cigar, a pickle, and a penis.

Upon its completion in 2004, this unusual yet centrally symmetrical form created a distinctive and consistent silhouette widely visible across London. Reproduced in countless advertisements, drawings, photographs, and postcards as well as in films, television shows, video games, and other media, the Gherkin has become one of the world’s newest urban icons, a junior partner to the Eiffel Tower, the Empire State Building, and the World Trade Center. The building has served as a powerful branding instrument for Swiss Re; for British design expertise, in particular that of the building’s architects, Foster + Partners; and for the London of Tony Blair’s New Labour, Ken Livingstone’s mayoralty, and the 2012 Olympics.1

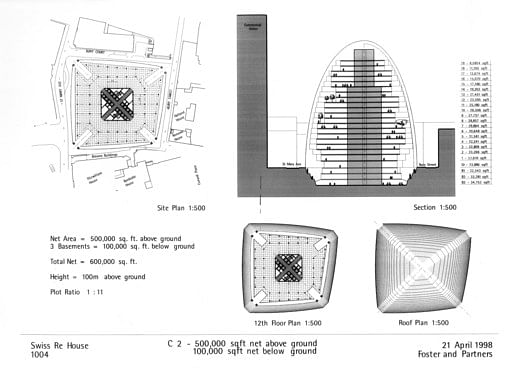

The building is unusual in form, construction, appearance, and servicing, reflecting the work of a large and multidisciplinary team of experts at Foster + Partners and many other firms who developed formidably complex solutions to problems of structure, cladding, and environmental control. (For a description of these solutions, see the accompanying slideshow and analytical drawing.) It won numerous local, national, and international awards for its planning, design, innovation, use of steel, and reinterpretation of the skyscraper type, including the Stirling Prize, granted to the most outstanding building built or designed in Britain over the preceding year. Nearly a decade after it opened, 30 St Mary Axe merits a second look based not on promotional statements and initial critical assessment but on firsthand observation, documentary and archival research, and interviews with developers, owners, planners, architects, consultants, and managers involved in its creation and operation.2

Like any icon, the building carries many meanings. As the Back the Bid poster suggests, prominent among these are risk and its management. Most generally, “risk” denotes the effect of uncertainty on objectives. More commonly, the term describes the quantification of uncertainty through the probabilistic calculation of likelihood for any kind of negative outcome. Risk was once a technical concept specific to maritime insurance. In the coffee houses and early exchanges of London’s nascent financial district it described the commodity that insurers sold and shippers bought to manage the economic danger posed by the uncertain conditions of travel by sea. As capitalism, with its dynamic of continual change, introduced ever more uncertainty into daily life ashore, over the course of the 19th century risk became part of broader Anglo-American economy and culture. Once located exclusively in nature, risk came to be recognized as a dimension of human conduct and society. Assuming risks became part of the freedom and self-mastery that characterizes modern liberal subjectivity.3

The expanding corporate economy rationalized contingency by generating new financial instruments of risk management: savings accounts; markets in bonds, futures, and stocks; insurance policies. In the 20th century, advanced industrial nations socialized certain kinds of risk through regulation, state health coverage, and social insurance. In constituting the nation as a risk community, these measures diminished the prevalence of risk as a framework for individual action. Since the 1970s, however, these large-scale risk communities have weakened and responsibility for risk management has increasingly returned to individuals and corporations. Sociologists and political theorists have identified risk as a major currency of governance and self-governance in neoliberal society.4

Since it entails imagining uncertainties and projecting potential futures, risk is always in some sense imaginary. It is “a construction of an observer,” in the words of sociologist Niklas Luhmann.5 The unique design of 30 St Mary Axe addresses the ways we imagine the risks associated with climate change, terrorism, and financial globalization. Spiraling atriums with windows that open to allow natural ventilation suggest that innovative design can help highly technological societies use less energy and slow down potentially catastrophic human-induced climate change. Protective barriers, security cameras, and a diagrid structure enclosing shops along a public arcade and plaza suggest that resilient design can secure the open society by making even a prominent terrorism target accessible and welcoming. A handsome new skyscraper in the City of London, the quasi-autonomous financial district at the heart of the British capital, suggests that quality design can enlarge the supply of prestige office space for global businesses without jeopardizing the visual appeal of London’s townscape for residents and tourists.

The Gherkin’s prominence as an urban icon stems in part from its success at engaging what we might call risk imaginaries: the discourses, representations, and practices through which we understand and conceptualize risks. For reinsurance companies, architects, and urban governance coalitions alike, risk presents opportunity for reward. The Gherkin reimagined salient risks so successfully that it seemed to diminish the likelihood of dreaded outcomes: flooding drowns London’s streets; bombings raise insurance premiums to prohibitive levels; scarcity of prestige office space sends multinationals to Frankfurt. By seeming to show that design could manage risks posed by climate change, terrorism, and financial globalization, the Gherkin leveraged perceptions of risk to generate profits, promote economic growth, and raise the currency of design expertise. In the process, it changed the social construction and impact of those risks.

By reshaping salient risk imaginaries, the building mediated significant changes in the City of London’s spatial form, economy, and governance. The Gherkin’s development established a new cluster of branded high-rise office towers that expanded economic activity in London’s financial district by changing its physical and urban character. Its planning and design provided a framework for revisions to planning regulations that favored the interests of landowners, developers, and multinational financial services firms over those of heritage conservationists—changes linked to a restructuring of governance that diminished the autonomy of the City Corporation, the City’s distinctive and traditionally insular government. The design and construction of 30 St Mary Axe are a smaller-scale instance of what Arindam Dutta calls “metaengineering”: the design of entire economies through intertwined architectural, urban, and policy intervention.6

Design is a complex practice that involves intuition, aesthetic judgment, and convention along with considerations of technology, construction, law, finance, and many other factors. Foregrounding the role of risk and its management in the design of the Gherkin shows how the distinctive features that made this building an icon were overdetermined by their efficacy at engaging the risk imaginaries associated with climate change, terrorism, and financial globalization. As its multiple risk management efficacies converged into a single design, they made the building the mediator of a new risk management regime. By “mediation” I mean that the building manifests broader forces in political economy, and in doing so it realizes, shapes, and conditions those forces—giving them their specific character and quality as it brings them into existence. Architecture is not simply generated by economics and politics. A medium for production and everyday life, it reciprocally conditions economics and politics as design instantiates power. The Gherkin is not just the marker of transformations in governance through risk; it has also been an agent in those transformations. Examining the building through the lens of risk highlights the agency of design in mediating change.

CLIMATE CHANGE

The Gherkin may have supported gymnast Ben Brown well in his Olympic bid vault, but it affords only precarious footing to the giant polar bear featured in a poster created three years later by activists from the Camp for Climate Action to publicize a mass protest at Heathrow Airport against the environmental degradation caused by air travel. Teeth bared, the bear stands atop the tower swatting at jets. Seeking purchase on the smoothly rounded tower, its claws grasp at the slight relief offered by spiraling mullions and fins.

Conflating the story of King Kong, a jungle monarch captured and killed by the metropolis, with the climate change icon of the solitary polar bear stranded on a melting ice floe, the poster associates the Gherkin with the rest of London’s corporate office towers through its sooty brown coloring yet sets the building apart by foregrounding its unique form and patterning. Like the Empire State Building for the famous gorilla, the Gherkin is at once the epitome of destructive capitalism and a redoubt that evokes aspects of the bear’s native environment while offering a dubious last chance for survival. Echoes of September 11 tinge the image with menace, suggesting that the Gherkin epitomizes the hubris of global finance. For artist Rachel Bull, the building is an ambivalent climate change icon courting risks beyond its capacity to manage.

30 St Mary Axe is an especially suitable focus for the Camp for Climate Action poster because the building had come to exemplify innovation in sustainable tall office building design. Even before its completion, the building intervened in one of the major risk imaginaries preoccupying architects and many clients: the perception that human-induced climate change threatens economies and populations. Articles about the design emphasized the mixed-mode ventilation that would cool the building much of the time. Many writers repeated the claim by Foster + Partners that the building management system would exploit these features to reduce the building’s energy consumption by as much as fifty percent relative to other prestige office towers. “Nature takes care of the temperature of the building,” explained Norman Foster in one interview. “It is only in extreme heat and cold that the windows close and the temperature is regulated by the automated air conditioning system.”7 The Gherkin was “London’s first ecological tall building,” in the phrase used by Foster + Partners and circulated widely in the press, and it soon became a case study in books and courses on building technology and sustainable design.8 The building emblematized the potential for architectural innovation to reduce resource consumption and so to reduce the likelihood of catastrophic climate change.

Managing climate risk was deeply inscribed in the design of 30 St Mary Axe because it was integral to the market mission and brand identity of the client. Swiss Re is a reinsurance firm, the world’s second-largest insurer of insurance companies. It manages the risks taken on by risk managers. Reinsurance emerged in the 1820s as a local and regional risk-spreading measure among fire insurers in Germany and Switzerland, becoming an integral part of the financial risk management sector as the insurance industry internationalized during the latter part of the 19th century. Created in 1863 by two primary insurers and a bank following a fire in Glarus, Switzerland, the Swiss Reinsurance Company by the turn of the 20th century was a leading firm in a globalized reinsurance market. While the San Francisco earthquake of 1906 tested its capacity to meet its obligations, the firm remained solvent to benefit from Swiss neutrality during World War I and from the weakness of Germany’s economy after the war, when the Swiss firm bought one of its competitors, Bavaria Re. The company expanded after World War II as social insurance became widespread among industrialized nations, and it has remained among the largest reinsurers alongside rival Munich Re.9

In 1995 the company created a new corporate identity, taking “Swiss Re” as its global brand name and adopting a new logo and minimalist graphic language. Shortly afterward, the firm constructed headquarters buildings for its operations in the United States and the United Kingdom, making architecture “a crucial communications tool and an intrinsic part of the Swiss Re brand,” according to Richard Hall, author of Built Identity, a company-sponsored volume on the firm’s architecture.10 Completed in 1999 to a design by Dolf Schnebli of the Swiss firm SAM Architekten, the firm’s U.S. headquarters building is an expansive four-story office building on a wooded campus in Westchester County north of New York City, where a staff of 1100 had previously worked in several midtown branch offices. Following its acquisition of British reinsurance firm Mercantile & General in 1996, Swiss Re embarked on a similar project in London, culminating in its creation of 30 St Mary Axe.

Natural catastrophes are the primary cause of insured losses, so Swiss Re attentively monitors and predicts the impact of weather and climate on economic activity. The firm emphasized sustainability in its corporate literature and policies before many others did; lighting designer Mark Major recalled receiving a “massive” sustainability manual from the firm, the first such document he had encountered.11 “For us, sustainability makes excellent business sense,” explained Sara Fox, the project director hired by Swiss Re to direct construction and occupation of 30 St Mary Axe, “because we pay claims on behalf of clients for floods, heat waves, droughts. To the extent that these claims are related to global climate warming, it is only prudent of us to contribute as little to it as possible.”12 At the same time, the company would seem to benefit from perception that climate change poses insurable business risks, so calling attention to climate risk could stoke demand for the company’s products.

By thematizing its environmental control systems and energy consumption features, Swiss Re’s new UK headquarters at once highlighted climate risk and demonstrated the company’s commitment to managing that risk through practices of sustainability, construed as a strategy for managing the business risk posed by environmental degradation and climate change. The building’s ostentatiously streamlined form, tinted glass spirals, and visibly operable windows called attention to its capacity for supplementing or substituting mechanical ventilation with natural ventilation. Intentionally understated lighting at the building’s crown emphasized restraint in energy consumption. The smoothness of that crown, where the doubly curving curtain wall resolves into a glass dome, eliminates the roof that so often supports chillers and fans—visible elements of industrial environmental control. By tucking this equipment into plant rooms near the top of the tower—as well as into the basement and a six-story annex building across the plaza—the building obscures the extent of its reliance on energy-intensive mechanical ventilation and temperature control. Instead of supporting mechanical equipment, the apex contains a private dining room with a 360-degree view that spectacularizes London. Seen from outside, as an element in the skyline or a distinctively patterned whorl in satellite images of the city, the summit of this distinctively roofless building stands out from neighboring buildings.

The architects brought to the project their own brand strength. Foster + Partners is unique among the world’s architecture firms in being both a top-grossing multinational and a high-reputation design firm headed by a star architect. With 646 architects on staff and annual fee income exceeding $200 million in 2012, Foster + Partners is the tenth largest architecture company in the world, and it held that same rank in 2003 as the Gherkin was nearing completion. With work around the globe that encompasses many medium- and large-scale buildings as well as infrastructure projects such as telecom towers, airports, and viaducts, the firm enjoys vast commercial recognition. This is particularly striking because it is the only firm of its size led by a single charismatic design principal and managed from one primary office. Perhaps because of this unusual character, the firm enjoys high levels of recognition from the state, the public, and the profession, as measured in honors bestowed by Queen Elizabeth on Norman Foster, accolades in the press and surveys, and architectural awards.13

The Foster + Partners brand is associated with highly controlled, self-contained buildings that employ modern industrial materials to celebrate technology and tectonic articulation. For Swiss Re—a company cultivating its image through architectural patronage—the firm likely appealed for additional reasons. The firm and its knighted founder were known and esteemed in British design and planning circles; they had already designed a tower for the St Mary Axe site for property owner Trafalgar House; and they had expertise and prior experience completing innovative buildings, such as the Commerzbank Tower in Frankfurt (1997), that incorporated natural ventilation and other systems associated with sustainability.

In its design for 30 St Mary Axe, the Foster firm employed a rhetoric of architectural organicism and evoked noteworthy precursor buildings to burnish the sustainability credentials of the new tower. In presentations to clients and planning officers, project architect Robin Partington likened an intermediate scheme to an egg, while Foster compared later versions to a pinecone. The firm constructed a lineage for the Gherkin that stretched back to the work of Buckminster Fuller, the onetime mentor of Foster’s who is a primary reference point for some concepts of sustainable design.14 The building’s architects saw the Gherkin’s interior atriums as successors to planted “sky gardens” in the Commerzbank headquarters. The plaza and shopping arcade at the building’s base were modest vestiges of earlier schemes that featured extensively tiered leisure and commerce zones. To the architects they evoked precursor projects that reimagined the work environment as a planted landscape of open-plan trays within a glass enclosure, including the landmark building the firm had completed in 1975 for the insurance firm Willis Faber & Dumas and the Climatroffice, a 1971 concept for a multilevel escalatored office environment enclosed by an oval triangulated spaceframe.

In the late 1960s and early 1970s, Fuller and Foster collaborated on a few unbuilt projects, and the Climatroffice was a direct adaptation of the U.S. Pavilion from Expo 67,

an early attempt to regulate building climate performance by automating environmental control systems. Intermediate schemes for Swiss Re, known colloquially as “the haystack” and “the bishop’s mitre” or “breadloaf” adapted the platforms and escalators of the Climatroffice and the U.S. Pavilion to the St Mary Axe site by partially submerging a stack of staggered floorplates below ground and encasing the stack in a glass-and-steel diagrid enclosure recalling Fuller’s spaceframes.15

With its diagrid structure, double-curving glazed skin, and automated building management system (along with a rotating sunshade intended for installation inside the apex but not completed), the Gherkin evoked the U.S. Pavilion’s five-eighths geodesic sphere stretched vertically to improve its aerodynamics and accommodate office floors to a height capable of realizing the value of its constrained but expensive site. With his collaborators Shoji Sadao and John McHale, Fuller intended the U.S. Pavilion to function as a Geoscope (a global hypermap) and a facility for exposition visitors to play the World Game, a scenario simulator through which they would test strategies for redistributing resources in order to maximize human well-being. The platforms and escalators that filled the Expo dome were added by another firm at the client’s insistence. At 30 St Mary Axe, as in the Climatroffice, Foster + Partners adapted the pavilion as built rather than as initially conceived, setting aside Fuller’s technocratic utopianism while adapting its forms, aesthetics, and technical solutions. Despite these differences, the building claimed the mantle of Fuller’s reflexive modernism, his attempt through technocratic design to automate processes of progressive optimization in resource use and so to steer humanity toward a more sustainable resource use trajectory.16

Like the U.S. Pavilion, the Gherkin suggested that the ecological risks of modernization could be managed through technological innovation and that sustainable design could promote rather than inhibit economic growth. In another parallel to the U.S. Pavilion, the automated environmental control features at 30 St Mary Axe failed to achieve declared objectives. In practice, the Gherkin has not achieved the economies heralded during its construction and first occupancy. Its vaunted energy performance is imaginary.

In the Olympic bid poster and most other depictions of the building, 30 St Mary Axe is sleek and self-contained, its every element integrated by a lucid geometry of circles and triangles. On Tuesday, April 26, 2005, though, that regulating geometry failed in a small but significant way when one of the building’s operable windows broke off and fell some twenty-eight floors to the ground. Building managers concluded that one of the mechanical arms controlling the window had failed.17 Following this episode, Swiss Re and its management company disabled the mixed-mode building control system as they tested and replaced the chain-drive motors controlling window operation. The system has been used on only a limited basis since. Many tenants have walled off the atriums, and some have insisted on lease provisions guaranteeing that mixed-mode ventilation will not be employed in their zones. Since 2005, as far as I can determine, the windows have opened only occasionally, and only on the lower floors, which are occupied by Swiss Re. This means that mixed-mode ventilation is available in only one of the four sets of six-story atriums. For all but its first year of operation, then, the building has run primarily on mechanical ventilation.18

One of the environmental consultants who modeled the building’s anticipated performance compares its owners and facility managers to overly cautious sports-car owners who never take the Ferrari out of second gear. But it’s not clear that the building could have lived up to the promised energy savings even if its mixed ventilation mode were fully activated. The enclosure and ventilation system combine building components taken from climate-control strategies that are usually deployed independently and that may not work together from the point of view of building physics. (See the analytic drawing here.)

The double-skin façade zones encased by clear glazing presume that air between curtain wall layers will absorb solar heat, rise due to the stack effect, and vent to the exterior through narrow slits at the top of each two-story structural bay. But these cavities are open at their sides to the two- and six-story atria that are intended to draw fresh air through the building by exploiting external pressure differentials.

These atria in turn are—or were—open to the adjoining office floors. Rather than operating as discrete systems, then, the cavities, atria, and floors are integrated into continuous air masses. So if the triangular operable windows were opened as intended for natural or mixed-mode ventilation, the stack effect venting of the double-skin facade zones, the pressure-differential venting of the spiral atriums, and straightforward cross-ventilation within a single floor could all be operating simultaneously—and at cross purposes.19

While consultants who worked on the building claim that the building management system can manage the potential conflicts among these systems, pointing to the performance simulations they ran using computational fluid dynamics so far as I have been able to determine the performance of the mixed-mode ventilation has never been rigorously tested or empirically confirmed.

Nor has this hybrid of ventilation systems been employed in another tower, by Foster + Partners or another firm, in more than a decade since the design was completed. The combination of double-skinned facade, atriums, and open floors connotes improved environmental performance and aligns the building with symbolically powerful precursors. But what it yields functionally is an internally incoherent environmental control system of undetermined performance capability.

The Gherkin makes extensive use of industrial materials whose manufacture consumes a great deal of energy, and the atriums give it an unusually low ratio of usable square footage to total square footage. If its provisions for natural ventilation aren’t used, 30 St Mary Axe is not a green tower, it’s an energy hog. So it’s striking that the building has been a critical and financial success despite its failure to realize one of the headline claims made about its design. In 2007, well after the window break and market preferences curtailed use of mixed-mode ventilation, Swiss Re sold 30 St Mary Axe to a pair of investment companies in a deal valued at six hundred million pounds, or $1.2 billion—at the time a record for the sale of an office building in the United Kingdom. The reinsurance firm, which took a long-term lease on the floors it occupied, netted a profit estimated at more than $400 million.20 Rather than substantively reducing the contribution that 30 St Mary Axe makes to climate change, its envelope positioned building and client advantageously within a climate change risk imaginary.

Even if it has not reduced the energy consumption of its occupants, 30 St Mary Axe has changed that risk imaginary by persuading people that design can manage the climate risk of postindustrial production. For this, the building needed to change perceptions, and this task was achieved by design features that highlight the building’s capacity for natural ventilation, combined with simulations that imagined how the building would perform.21 In legitimizing the building as an exemplar of sustainable design, the simulations created space for the design risks that this innovative and cynical building runs. Addressing the imagination rather than the climate, they bought its designers freedom.

TERRORISM

Mornings the Zamboni scrubs the plaza. Moving across the pavement in parallel lines connected by tight turns, the sweeper cleans the stone of cigarette butts and spilled food and beer left the night before by the underwriters and bankers who patronize the bar and shops in the building’s perimeter arcade as well as the adjacent restaurant that in fair weather sets up outdoor tables and chairs.

By pulling away from its irregular property lines, the tower achieves almost perfect formal autonomy from its context. The gap between the circular tower base and trapezoidal site boundaries forms a privately owned public space (see also the third image, “Site plan showing the plaza and context of 30 St Mary Axe.”), a civic and commercial amenity in this densely built part of the City.

The plaza is much reduced in activity compared to what Foster + Partners envisioned during the schematic design and permitting phases of the project, but it is handsomely detailed with granite paving, including ramps and benches along the low walls that separate it from the adjacent streets.

This residual urban space allows visitors and passersby to see the building’s curving sweep and to appreciate visually its formal coherence. It also creates a security perimeter, a glacis or open zone permitting video surveillance of all approaches by some of the roughly 115 CCTV cameras located on the premises. Within the building, access to the office floors is controlled by lobby turnstiles that admit staff by card-swipe. Visitors must pass through airport-style security screening at an x-ray and metal detector station to the right of the turnstiles behind the reception desk. Card-swipes also control access from the elevator banks to the office floors above.

These techniques for monitoring and controlling access are standard for high-quality office space in the City. Financial services firms have constructed protected enclaves for their workers since the early 1990s, when the City responded to a series of Provisional IRA bombings by instituting new territorial strategies as a way to “design out terrorism.”22 30 St Mary Axe sits within the security perimeter known as the “Ring of Steel”: the array of access controls, barricades, automobile checkpoints, license-plate tracking, security cameras, traffic monitoring, parking restrictions, and stepped-up policing that encircles the financial services core of the City. By creating a nested series of security perimeters, the building reinscribes the Ring of Steel at multiple scales. (Again, see the analytic drawing here.)

The plaza is one such device. Shielded by its low walls and planters as well as by bollards capable of stopping a car or truck, the plaza provides “standoff,” the protective distance that mitigates the impact of a bomb blast. Another security perimeter is provided by the building’s structural system. The lateral stability of the perimeter diagrid provides superior blast resistance as well as structural redundancy in case part of the steel cage is knocked out by a bomb or vehicle. The curtain-wall that clads the diagrid enhances the protection it affords: consultants who worked on the project noted that the building’s double-curving form—key to its deflection of wind—would significantly reduce the impact of blast forces in the event of another bombing adjacent to the site. Toughened and laminated glass sheets designed to flex and then break into harmless pebbles are set into deep, cushioned rabbets capable of absorbing additional blast energy. The decentralized and zoned HVAC system, which draws air in through narrow vents between window courses at the edge of every floor and heats or cools it locally using circulating water pipes, eliminates the risk that a chemical or biological attack will travel through centralized air handling systems from a mailroom or main intake.23

By integrating an array of security measures into its design, 30 St Mary Axe exemplifies the cultivation of resilience as a response to the threat of terrorism. (Following the World Trade Center attack in September 2001, with the Gherkin’s pilings already sunk, the steel purchased, and stairs and elevators locked into place, the architects, consultants, and developers performed a resilience check on the building. After concluding that the diagrid structure was likely to survive an airplane impact without collapsing, they strengthened bollards, added a guard station on the truck ramp, eliminated vendor carts from the plaza, and retrofitted what was to have been a property management office behind the lobby with airport-style x-ray and metal detector screening for visitors.24) This building secures itself against anticipated forms of terrorist assault as well as can be imagined given its tight siting and provision for businesses and public uses in its base and plaza. In security jargon, its features provide target hardening designed to discourage attacks and direct them elsewhere through a carefully modulated combination of overt and implicit strategies. Bollards, visible cameras, and security checks encourage target substitution by generating security theater. But because many of the truck barriers are built into the landscaping, blast resistance is integrated into the overall building form, and air intakes are sublimated into curtain-wall joints, the building masks many more of its security measures from daily perception.25

The security provisions at 30 St Mary Axe are not uncommon for new office buildings in the City of London, one of the world’s most heavily surveilled and secured open urban zones. But in this case, security features that the building shares with other prestige office buildings were not only determined by City conventions and policies; they were overdetermined by the profiles of the site and the client.

The property developer was able to purchase the St Mary Axe property and secure planning permission for a tall new building in the midst of a tightly regulated historic preservation zone only because the site had been partially cleared in April 1992 when the Provisional IRA detonated a bomb consisting of one hundred pounds of Semtex and a ton of fertilizer inside a van parked at 28 St Mary Axe. The blast severely damaged the listed neoclassical building housing the Baltic Exchange, the international shipping exchange that since the mid-18th century has been part of the City’s financial sector and the global mercantile economy. The bomb also precipitated planning and policing studies that led to creation of the Ring of Steel following a second bombing one year later in Bishopgate, just a block away from St Mary Axe.

As it looked for a building in which to consolidate staff from offices at five different City locations following its acquisition of Mercantile & General, Swiss Re considered thirty-three potential sites. Most were clustered in the City, but the range extended to the West End and the South Bank of the Thames as well as to the nearby Docklands.26 When it agreed to purchase the St Mary Axe site, the reinsurer negotiated a complex transaction that hinged on the seller securing planning permission for a new tower. Site options in the City were scarce, particularly in the area around the Lloyds insurance exchange and other industry firms. But the company had other options for consolidating, and it needed only about half the office space it intended to build, since much of the new building would be speculative rental space.

Increasing efficiency across Swiss Re’s London workforce and marking the presence of its expanded British operations were likely prominent motivators for company executives. But in choosing to consolidate its London workforce into a single tall building sited on the Baltic Exchange property, Swiss Re significantly increased its terrorism risk exposure.27 Since the company’s business is reinsurance against risks, including those of terrorism, the exposure it purchased at 30 St Mary Axe was not only a liability—it was also an asset. By highlighting the company’s commitment to managing terrorism risks through prudential planning, design, and policy, a distinctive new building on a symbolically charged site like this created value for the reinsurer as it expanded its activity in the UK market.

The more prominent the building, in fact, the greater the exposure—and the greater the potential branding value for a reinsurance company. The Foster design realized those benefits by capturing attention and branding the site with Swiss Re’s corporate identity. This dynamic made 30 St Mary Axe an icon not only of climate change but also of terrorism risk management, acclaimed in the insurance industry press by leading terrorism risk consultant Gordon Woo and selected to illustrate the cover of a book about blast effects on buildings.28

By soliciting risks and handling them ostentatiously yet seemingly effortlessly, 30 St Mary Axe accrued capital for the clients and the City of London, for the architects and their consultants—and also for design as a risk management practice. With each solicitation, gain, and management of risk, the design acquired agency by becoming a stronger branding instrument.

One dimension of the brand that this urban icon builds is an association with changes to British governance practices. Swiss Re’s selection of the St Mary Axe site for its new building highlighted the company’s participation in Pool Re (Pool Reinsurance Company Limited), the British mutual reinsurance system established in the wake of the Baltic Exchange bombing to keep premiums from becoming so high as to drive companies out of business—or out of the City and other terrorism target zones. Created in 1993, Pool Re spreads insurance liability for terrorist attacks and other catastrophes across all the insurers active in the UK market. Because extreme losses beyond predefined commitments made by the private insurers are guaranteed by the British state, Pool Re spreads ultimate liability across the entire UK taxpayer base, socializing some of the most extreme risks borne by private insurers and reinsurers.29 This collaboration between the state and a globalized insurance market in creating a new risk management regime is one of the neoliberal mechanisms for “governing at a distance” that have displaced the insular “club government” that prevailed in Britain, and particularly in the City of London, from the late 19th century to the late 20th century: a tradition of self-regulation by private institutions and their socially vetted leaders operating via informality, tacit knowledge, and autonomy from public scrutiny and accountability.30 As both the UK headquarters of a major reinsurer and a valuable asset within the terrorism risk zone covered by Pool Re, 30 St Mary Axe emblematizes the new arrangements whereby risk mediates British governance.

GLOBALIZATION

Unlike New York and other cities in which zoning codes entitle landowners to some kinds of development “as of right,” the City of London regulates property development through case-by-case review by planning officers, who judge how well proposed construction conforms to City-wide plans and guidelines regarding factors such as building height, development density, access to transit, impact on views and the visual character of the area. In order to develop the Gherkin, the property owners and Swiss Re had to secure planning consent from the City Corporation, the governing body of the City of London, through its chief planning officer, Peter Wynne Rees. The review and permitting process that culminated in the granting of planning consent in August 2000 spanned not only the planning office but also the market, the courts, and the press. Rees brokered a multilateral negotiation so intensive that we could almost say the building was designed by bureaucracy. Part of that negotiation entailed imagining and staging risk: climate risk and terrorism risk, but especially the financial risks associated with globalization.

As the Olympic bid poster reminds us, the Foster + Partners design for 30 St Mary Axe helped the City of London to rebrand itself as a center of innovation and investment, and so to secure the City’s position within a neoliberal economic geography construed as a competition among cities for global capital and its management.31 These triumphalist associations mask a more complex history, though. It would be more accurate to say that the building brokered a renegotiation of authority, decision-making, and spatial control through which the City Corporation traded a measure of the autonomy it historically possessed in order to retain meaningful sovereignty in a changing world.

A block west of the St Mary Axe site was the 47-story Tower 42, designed in the late 1960s by Richard Seifert and at 183 meters then the tallest building in the UK. Since the building’s completion in 1981 the City had enforced an unwritten prohibition on further skyscraper construction, steering developers and architects toward the design and construction of “groundscrapers,” low-rise but horizontally extensive buildings that evoked neoclassical business palaces of the Edwardian era while providing minimally obstructed floorplates along with the communications cabling and air conditioning required for computing-intensive trading.32 These large buildings, which emulated North American precursors in providing the large floorplates and open workspaces preferred by multinational corporations and large financial firms, reflected a concession on the part of planners to a transnational range of clients and developers increasingly prevalent in the City office space market after the “Big Bang” banking deregulation of 1986.33 Construction of the Canary Wharf development in the Docklands had created a second business district a few miles to the east, its American-style skyscrapers drawing some large banks and financial services firms from the City, which was also conscious of competing with Paris and especially Frankfurt for the footloose capital of Europe’s financial services business.

In 1995, shortly after it purchased the St Mary Axe site, Trafalgar House secured permission to build a new groundscraper incorporating the façade and exchange hall from the damaged Baltic Exchange building and designed by GMW, a firm that had built some of the City’s 1960s office towers. After acquiring Trafalgar House in 1996, the Norwegian engineering and construction services corporation Kvaerner reconsidered this approach. (By the time the contract with Swiss Re was concluded in 2000, Kvaerner in turn had been bought by Skanska, the Sweden-based multinational that ranks among the world’s largest construction companies.) Based on weak market response to this design, and facing a deep financial crisis, the company pushed for permission to build an office tower capable of realizing greater profit from the rare opportunity presented by a nearly clear site in the City’s insurance district.

For Kvaerner, a design capable of raising the value of the site by securing permission for a taller and more desirable building was a way to avoid bankruptcy by selling the land at a substantial profit and winning a large construction job, since securing the construction contract was a condition of sale. For English Heritage, SAVE Britain’s Heritage, and other preservation advocates who opposed the initial Foster designs, the prospect of a skyscraper on the Baltic Exchange site risked jeopardizing the visual management framework that regulated development based on a network of protected views toward the dome of St Paul’s Cathedral.34 Negotiating among the various parties to the development process challenged the City Corporation to balance the risk of breaking the conservation-oriented spatial regime it had maintained since the early 1980s against the risk of losing its primacy as a location for financial services to competing locations. The team that developed the Gherkin for Kvaerner and Swiss Re had worked together previously in developing Canary Wharf. By suggesting that they would build in the Docklands rather than occupy the consented GMW groundscraper, Swiss Re and Kvaerner pressured City planners—but also empowered them—to lift the prohibition on tall buildings. This stance was a bluff, but it established one component in the rhetorical framework within which the City ultimately changed the regime regulating its architectural and urban form.

The other component of that framework was design. Kvaerner hired Foster + Partners in 1996 to draw up an office tower for the Baltic Exchange site. From the start, the task of this design was to realign risk imaginaries so that for Rees and his City Corporation constituency the risk of denying permission for a tall building would seem to exceed the risk of granting it. The Foster firm responded with the Millennium Tower project, an implausible proposal imagining a skyscraper with 1,700,000 square feet of floor space that, at 385 meters tall, would have dwarfed every other building in Europe.

This design was a provocative bargaining posture signaling to the heritage lobby and the City Corporation that the new owner expected to be able to build a tower on the Baltic Exchange site. Shortly afterward the Foster firm prepared a more realistic 170 meter version for Kvaerner to show to prospective occupiers.

When Swiss Re retained Foster + Partners following its purchase agreement with Kvaerner, the architects generated a new version of this shorter tower, 100 meters tall, and entered multiparty planning discussions. From February 1998 through summer 2000, Foster + Partners and Swiss Re worked closely with Rees and his staff, in conversations incorporating English Heritage and other interested parties, to generate a series of variations on the design that culminated—following procedural challenges, lawsuits, and debates in the press—in the approval in August 2000 of a design close to the completed building. Rees allowed Swiss Re to develop a large volume of office space in a tower just three meters shorter than the NatWest Tower. In return, he extracted concessions: the building would provide a public plaza, it would accommodate retail uses, and it would achieve a high standard of “design quality.”35

The granting of planning consent for 30 St Mary Axe did not only reflect a shift in policy regarding this particular site. It also initiated a new regime of spatial regulation governing development in the City. Codified two years later in a new Unitary Development Plan, this regime welcomed high-rise towers within “clusters” that deferred in some degree to the view corridors around St Paul’s Cathedral, so long as the new buildings provided public amenities and exemplified quality design.

Towers permitted under this new regime include Heron Tower, the Leadenhall Building (The Cheesegrater), Broadgate Tower, the Pinnacle, and 20 Fenchurch Street (The Walkie-Talkie).36

Branded like 30 St Mary Axe with signature profiles and nicknames, these skyscrapers maximize the value of City land while using design to raise rents and profits. This regulatory shift allowed local and multinational landowners, developers, and investors to capitalize on the increased value of City properties, and it reasserted the primacy of the City of London among the world’s centers of banking, insurance, and finance. Led by the Swiss Re project, these towers have transformed London’s skyline, urban character, and real estate market. A study conducted a couple of years after completion of 30 St Mary Axe found that the Gherkin had displaced the dome of St Paul’s as the most prominent City landmark in the perception of City workers.37

Among the economic sectors benefiting from this wave of construction are architecture, engineering, construction, and related consultancy fields. The design and construction of the Gherkin was globally sourced through a network centering on several London firms, including not only Foster + Partners but also the giant engineering and planning firm Arup, environmental consultants BDSP Consulting and Hilson Moran, the interiors firm TP Bennett, lighting designers Speirs and Major, cost consultants Gardiner and Theobald, planning consultancies Montagu Evans and Richard Coleman Citydesigner, and many others. Much as the building showcases Swiss Re’s confidence in the face of risk, it also highlights the advanced expertise in design and construction that make London a hub in global networks of highly remunerative specialized production.38

This is the point of “‘The Gherkin,’” one of sixteen Postcards from the Future exhibited in 2010 by Robert Graves and Didier Madoc-Jones.

The image depicts a six-story segment of the Gherkin in a dingy, quasi-ruined state. Windows are missing. Drab curtains block our view of the dark interior, but in the perimeter zone between the outer and inner curtain walls hang laundry lines like those in photographs documenting the back balconies and fire escapes of Victorian East London. A solitary Union Jack drapes listlessly over the frame between two empty windows. “Refugees from equatorial lands have moved north in search of food,” explains the caption. “They make their homes in the buildings that once drove world finance—before the collapse of the global economy.”39

What does climate change mean? Monkeys and camels in Central London. Rice paddies in Whitehall. Shantytowns at Trafalgar Square and Buckingham Palace. The Thames flooded and frozen. These are some of the ways that Graves and Madoc-Jones imagine the potential impacts of rapid climate change on the British capital as they ask: “Wish you were here?” Charged with ambivalence, the postcards capture beauty as well as squalor, exhilaration as well as discouragement. But the primary message taps anxieties about immigration, multiculturalism, and post-imperial decline to warn that climate change puts at risk cherished emblems of a certain Britain.

While most of the older London icons in the series are associated with the royal family, the newer ones emblematize progressive technological innovation. Like the Thames Barrier and the City Hall (another Foster + Partners commission), the Gherkin figures here as a memento of warnings unheeded, leads unfollowed. The postcard of the ruined Gherkin—created by architectural visualization specialists with close links to Foster + Partners and other firms involved in developing the building—supports the expertise in architecture, engineering, planning, and development that produced the building by suggesting that ecological modernization can keep Britain rich, comfortable, and white. The series leverages concern about climate change to support the agenda of ecological modernization: mining ecologies for new sources of economic growth and profit.

As a high-performing investment vehicle and real estate development instrument imbued with aesthetic appeal and iconic value, the Gherkin helped to secure the position of the City—and with the City, London and the UK at large—within the economic geography of neoliberalism. This achievement has been marked by triumphalism, with the building celebrated not only in London marketing materials and professional awards but also on postage stamps and in other venues. But as geographer Maria Kaika points out, construction of the Gherkin should also be understood as a defeat for the City Corporation, since achieving these economic gains entailed the loss of a measure of control over the city’s form and appearance. Kaika situates the 2002 Unitary Development Plan in the context of other changes to the structure and governance of the City Corporation—including revision of its own name and brand, changed in the same period to Corporation of London—that reflect an institutional crisis. Pressure from transnational corporations and capital since the Big Bang, she argues, “forced the City to reinvent its spatial identity” in a way that favors skyscrapers over conservation considerations as it generated a form of architectural patronage identified not with City’s traditional institutions but with transnational capital elites. The towers built since 2002, she concludes, are not the “commitments in stone” of a prior era but rather “functional objects of capital accumulation” that “operate more as branding objects for multinational corporations or as speculative objects for real-estate developers.”40

Like the towers that have followed and to some extent eclipsed it, the Gherkin is both a branding device and a speculative venture. But rather than being the first product of the new Unitary Development Plan—the result of institutional restructuring—as Kaika suggests, 30 St Mary Axe precedes the 2002 Plan, and its process of development and design mediated the restructuring of spatial regulation that she describes. The Gherkin brokered this phase in the demise of club government, the rise in Britain of the neoliberal regulatory state, and the City Corporation’s bid to maintain its sovereignty by ceding some of its autonomy—a measure of its control over its spatial form—to transnational capital.41 By using design to reshape the risk imaginaries associated with climate change, terrorism, and especially financial globalization, 30 St Mary Axe redesigned the City of London’s economy and spatial form.

RISK DESIGN

Survey Foster’s London from the private club at the top of the Gherkin. At your feet is the Square Mile, dotted with and fringed by Foster + Partners office buildings: Moor House, the Wallbrook, offices at 10 Gresham Place, and headquarter buildings for Bloomberg, Allen & Overy, and Willis. To the south are buildings at Tower Place and, just across the Thames, the new development of More London, including several more office buildings and the striking City Hall—leased by its private developer to the Greater London Authority. Downriver to the east in Canary Wharf you’ll see the Citibank tower and the HSBC UK headquarters. With a little imagination you can picture the Canary Wharf Underground station, too. Upriver to the west are several more projects, including the Millennium Bridge across the Thames, a redeveloped Trafalgar Square, the National Police Memorial, the roof over the British Museum’s Great Court, buildings at the Imperial College, and Wembley Stadium.

Your view of some of these buildings will be blocked by the even taller skyscrapers that have gone up nearby since 2004 as the cluster has grown. You’ll still see the river, though, where you might spot one of the YachtPlus 40 powerboats that Foster designed cruising upriver toward the Albion Riverside offices and the Riverside Apartments and Studio in Battersea. This is where the firm is headquartered. It is also where Foster kept his primary residence until 2008, when he transnationalized himself and became a tax exile—footloose rather than place-loyal, a Swiss citizen rather than a British Lord. The previous year, Foster had restructured the firm (valued at about 300 million pounds or $593 million) to prepare for eventual succession and cashed out by selling a forty-percent stake in the company to a London-based multinational private equity and venture capital firm.42

By building so many prominent commissions associated with millennial London, Foster + Partners has strongly shaped the cast of the contemporary city.43 Modernist but classically so, favoring self-contained and symmetrical geometries along with a high standard of craft and the deep detailing of high-quality materials, the architecture of Foster + Partners connotes progressive innovation. The firm’s impact on the city has become so extensive that it must be considered in urban and economic terms, as a practice of metaengineering. Like Arup, and often—as in the case of 30 St Mary Axe—in partnership with Arup, Foster + Partners designs not only buildings but also economies and governance practices.

Foster and the firm he founded have been central to remaking London over the past two decades because their architecture fits the vision of New Britain put forward by New Labour from the mid-1990s through the 2000s, including neoliberal methods for governing at a distance through risk.44 Noting that the firm’s buildings more often provide the appearance of rationality than they deliver rational functionality, some critics have concluded, as one puts it, that the firm “supplies the look of innovation without the pain of actually changing anything” for a British establishment seeking to maintain its authority by appearing to change.45 Studying the Gherkin suggests a different conclusion. Addressing the ways we imagine risk and opportunity in climate change, terrorism, and financial globalization, the firm’s buildings sometimes use design to transform economies and governance.

Transparent Peer Reviewed

Cite this piece as Jonathan Massey, “Risk Design,” The Aggregate website (Transparent Peer Reviewed), accessed October 23, 2013, http://we-aggregate.org/piece/risk-design.

***

For full endnotes, please visit this article's original posting on Aggregate.

No Comments

Block this user

Are you sure you want to block this user and hide all related comments throughout the site?

Archinect

This is your first comment on Archinect. Your comment will be visible once approved.