According to the AIA, prior to 2008, there were 230,000 people employed in the architecture industry in the US. Between the collapse of 2008 and October of 2009, 39,000 people lost their job (17%). I couldn't find numbers since October, but gauging from word of mouth and job postings, I would be surprised if that number is above 20% today...so that's where we are right now.

According to the AIA construction spending survey released last month, construction spending in 2010 will decline by 13% in 2010 (for non-residential building), and grow 2% in 2011, modest, but a significant uptick from the previous year. The bad news is construction spending is still declining as indicated by the average architectural billing index last summer stagnating around 40 (50 is the break even number)

The good news is we should expect to see an increase in Architectural Billing in the next few months since the billing index (ABI) leads construction spending by 9-12 months. So in other words, the clients for the 2% in 2011 should be chatting with architects right about now.

I also read somewhere that residential remodeling should be strong compared to other sectors in the construction spending report, so there is hope for the small guys too.

I don't want to sound overly optimistic, but these are the macro numbers as they are which provide a small glimmer of hope...so keep your ear to the ground and keep your nose to the grindstone kids!

I intentionally left national economic trends out, but the architecture industry seems to be on par with GDP projections for the country (slow growth) Just saying to look at the numbers before pulling out the bottle of whiskey.

how bad will depend on where you are. Many municipalities have embraced "buy local" doctrines on hiring consultants. Texas and Colorado are doing alright. California and the northwest will have an odd combination of continuing misery and some bright spots. The Northeast is still somethng of an enigma. I have no idea what's going on in Dixie. People should flee Florida. Just run for dear life.

30% of firms are reporting that at least 10% of firms in their area have closed or are likely to close due to the recession. Would be curious to see how close the perception of respondents is to reality once the recession eventually ends.... are firm owners too optimistic or pessimistic about their competitors' survival prospects?

gresham - that graph is pretty sobering. I know of several firms that have ate the fish in this downturn, but all of them being smaller ones. Also know of some larger firms that have got gobbled up by even bigger ones. I think the only thing we know for sure is that the landscape of arch firms will be forever changed.

I like to be optimistic but more and more I have serious doubts we'll ever go back to business as usual circa 2007. Long term clients have told me straight up they will "never" do expansion like they did throughout most of the mid-2000's. Thus, the co-workers that were let go will probably never be rehired.

Right now everyone seems eager to celebrate the small victories, and that's fine. A lot of people need every bit of confidence they can find. Then again, if we aren't going back to BAU, at least in our lifetimes, when are we going to start having a serious discussion about seriously downsizing this profession?

The private sector has been doing the downsizing on their own, with harsh realities for those affected, i.e. all of us in one way or another. But academia still seems quite content to graduate swarms of new labor into the field each year. Obviously a downright terrifying job sector isn't scaring off students as they probably blindly believe we'll be going gangbusters again after the several years they spend studying. Maybe hiring managers at large firms should be speaking at Into Arch classes around the country.

I would argue that 2007 was hardly business as usual. It was the tail end of a bubble of unsustainable growth, and shouldn't be held as a benchmark for the coming years. I think a broader look at the industry would help us manage expectations.

Secondly, I don't think it's just about job seekers maintaining confidence, but also employers having the confidence to project growth instead of constantly worrying about diminishing fees. These projections enable employers to consider long term employees, in whatever limited amount, for the first time in over 2 years.

sobering but not that bad, considering that the average architecture firm has around 10 employees - qualifying them as a small business. The run-rate, annual closure rate of small businesses in the US during a NORMAL economy is 4-6%, and now closer to 15-20%, in the recession. So if 6% say that over 25% of the firms in their area with close now or in the near future (which I'm reading as within one year) that's actually not that bad of a national weighted average.

Heck, there may even be 6% of practitioners surveyed coming from Florida, where there is a mini-architectural armageddon going on (I think the Miami Herald reported 70%+ unemployment among the state's architects last October).

Depends on who you read or listen to, but I don't see any positive movements in the market. Tiny glimmers of hope, but not one thing I would call 'real'.

It boils down to jobs and consumer confidence... I think as far as architecture firms goes, this year at least can't be as bad as last year... Hopefully say around April, as firms have started their new fiscal years, they may have some new projects or prospects and may return to hiring mode...? The way I see it, we need to wait this thing out... Eventually, with so many firms having contracted and some left the market... Once projects return, there should be a return in demand for architects...

I want to be optimistic about 2010, but I'm generally a glass half full... Find your way to get through, and eventually it will come back... This is the nature of a cyclical industry... Every recession you will get those who cannot take the swings and may leave, and others who find better careers in other industries...

I agree that when things move forward again, and eventually there will, those firms ready to ramp up will prosper. That's also the nature of cycles - those prepared will reap the rewards.

I pray that we'll all be caught off guard on how fast things shift, as they tend to move faster than can be anticipated. When that happens, who knows.

I also pray that article I posted is wrong. If it is right, then we better buy some guns, water, food and booze and head to the mtns. :-/

my instincts tell me not to trust a guy in a pink shirt, but i'll bite. going back to the construction spending survey, the commercial building sector is projected to grow the most from -18% in 2010 to +10% in 2011, and since these numbers lag activity in this sector, we may be witnessing a small bubble in commercial development. if we're taking the long view on this, this year may just be a minor up tick in a very slow recovery.

About 25% of the construction labor market is unemployed. This means that people who make construction happen are more than likely short on cash and credit. It will be difficult to motivate these people back into their jobs.

AS far as this is concerned, this will greatly affect mobility-- meaning that you shouldn't be surprised if relocation expenses are itemized on your contractors statements.

For areas like Florida, Arizona and California... there might actually be labor shortages in areas due to construction workers chasing stimulus projects.

2) Commercial real estate markets

While defaults on residential mortgages are stagnating, CRE (commercial real estate) defaults are on the rise.

Real Estate Econometrics put the figure at 4% in December with an increase of about a 1% increase per month over the next year.

This has good news written on it though. As figures scare major real estate investment firms, these firms will start to liquidate long-term lease land and existing properties.

3) Construction Material Cool Down

With the exception of copper and wood, material prices are plummeting.

Steel is down something like 12% and concrete is down 8%. If trends continue downward, investors will start considering building again. This means in the short term there will be land acquisitions, planning, documentation et cetera to get projects started enough so that materials can be bought and prices locked in.

4) Delays and non-support

There is a nationwide trend going on in municipalities where entire local governments are essentially shitting down, cutting their staff and maintaining only minimal services.

This could be especially challenging if you're building bigger projects as there will no longer be planners and economic development types securing you credit, tax cuts, fast track permitting or zoning changes.

I'm curious: of those of us who are making predictions, how many of us have actually seen several recessions before and experienced more than one other downturn and lived on to tell the tale? It seems to me that most of the people Ive talked to who have been around for a long time and seen recessions come and go are less likely to panic, generally mire used to the cyclical reality of our industry? Is this recession really that different from all others which have come before?

I think one of the larger issues here is a three part issue.

Depreciation calculation methodology will almost certainly always favor certain land and building uses over others.

For Mixed-Use, Rental and Commercial... the depreciation timeline is 39 years. For most other properties, it is 29 years.

This means it is harder to recoup the costs in the short term, favors smaller loan periods and gives no incentive to build more complex, bigger and or permanent buildings.

This is compounded even further that the maximum allowable write off for depreciation is $250,000 dollars per deduction no. 179 regulation. So, if we do an ass backwards calculation... there is no incentive to build buildings with values of more than $10,000,000.

There's also no incentive in replacing appliances and other capital goods for this reason.

Lastly, commercial real estate prices (and by extension, residential high-rises) are entirely way overpriced.

If we take the Burj Whatever-it-is... with all of it's bells and whistles... averages $300 per square foot.

That comes out to something like less than $50 per square foot (at cost) annually in rent. There are offices in Manhattan that don't have massive leaking shark tanks in them or are 3,000 feet tall that rent for higher than that.

And street level retail space? Are you kidding me? How the hell does anyone afford rent?

The fact of the matter is that most of this stuff is wayyyyyyy over priced.

Not even people making good money can afford $200,000 in annual rent for a 2000 square foot retail space. Even if you were say spending 50% of your expenses on rent, you'd have to sell 10 t-shirts per square foot to stay in business!

trace - the only game in commercial right now is 'build to suit'. which means you better have a solid relationship with the developer or agent representing the client. or the client themselves.

silver lining is that those deals seem to be much more 'solid' financially than all the spec work - much less chance of getting hung out to dry on the fees.

The only reason non-residential construction might be in the plus 2% range for 2011 is horizontal construction. Vertical construction is expected to decline for 2011 as well. I don't know to many architectural firms that participate in road design. This is probably why you are not getting the meetings with these potential clients. Construction materials have held steady or increased. The idea that prices have plummeted is a myth. The only thing that makes it a good time to build right now is the undercutting of your competition that is resulting in GC's bidding projects at cost and below cost planning on change ordering their way into the black. The commercial real estate market is primed to fall straight off a cliff. Anyone who is considering building right now must have the tenants lined up and under contract. Shortly their will be many newly built CRE properties available at fire sale prices.

Panic does no one any good, but better to be prepared.

well said, montagneux. You just concisely summed up what I've been saying to people for the last year with commercial contracts. Commercial real estate prices are still way overpriced and overbuilt and have nowhere to go but down.

Anyone see that new home sales hit an all-time low today? An article in Bloomberg today pointed out that home prices in much of the country are still above where they should be when we take into account historical price trends.

I agree with much of Trace's posted article, with the caveat that it's still too much doom & gloom.

1. We've got a government that's passed some legislation to help out with credit card defaults.

2. I think housing prices could either drop a little more or stabilize. There won't be price growth for another 3-5 years and when there is, it will be anemic. They can either drop below historical trends and then begin another ascent or continue to muddle-through. I see the latter as being more likely.

3. While banks are still undercapitalized and would be pretty screwed if all their commercial lending fell through, they have been capitalizing rapidly. The larger banks have been shored up via Obama's printing presses. With the passage of healthcare and a slew of other bills, if the democrats are able to stay popular, or if the tea-baggers split the conservative vote, we'll have a powerful government that can work through this stuff. While I realize there's a lot of corruption going on here, the alternative of a stalled government and massive bank failures would really make it time to get out the guns and move to the country.

4. More businesses will walk away, but it's not an all or nothing situation. There will be negotiations and deals will be brokered. I just saw this happen recently with a job. The developer / owner didn't think he'd be able to find someone to lease the new property. Eventually, they did find someone and negotiated a deal where the developer's profit margin is really, really low (for how much risk they took) but which does allow them to make a small profit and keep afloat for the next 10 years.

5. That fifth point about the end of government bought mortgage backed securities does worry me a lot. Not sure how that's going to be handled. But again, the printing presses and flexibility of a strong government are available.

I'm not saying that any of this is "good", just that I think there's a better possibility that we muddle-through for the next three-four years.

At the end, the author questions where the new jobs will come from. People asked similar questions before the mid-90s & during the mid-80s. There's really no way to predict where the next wave of innovation will come from, or if it will come at all. There are a lot of elements of chance and luck here. It could be something sexy like biotech or green technologies, or it could be something less interesting like resurgent manufacturing due to a revaluation of the Yuen.

In the meantime, we shouldn't count on federal stimulus for massive infrastructure projects. The money is meant to go for projects already in the pipeline or for small fixes. This is smart, politically. New, large developments in the cities of the US take decades to get the ball rolling, mobilize NIMBYS, are always way over budget, and are already too small or redundant once completed. We should focus on creating small changes in our communities that utilize what we already have.

For instance, I was talking to my friend the other day, who works for a planning department in a small coastal town. The department is all in a tizzy over a plan proposed by some students to build a freeway cap that would connect the city to the beach with the goal of bringing more people down to the water (it's a great surf spot).

While I like the formal idea of freeway caps, the problem with the scheme is that it would cost a cool 200 billion to get built (and probably end up being twice that when all is said and done). On top of that, you've got different jurisdictions governing the right of ways over the freeway.

Meanwhile, down the road, you've got an existing bridge that looks kinda old and isn't used by anyone.

The idea he proposed to his bosses was to take their existing fleet of old busses, many of which aren't used, and fix them up with a couple million of stimulus funds and call them party buses. Set up a website to make it cool. Slap some paint on the old bridge and have community events down near the water. Maybe splurge and build a cool pavilion but focus more money on creating a program that works to make these events fun.

To me, in the short-term, it makes more sense to spend a couple million on something like this, instead of 200 billion (probably more) on something massive that will end up annoying people during it's 5-10 years of construction.

Sorry for the long post and I'll probably end up being wrong in most of my predictions. I'm not against large infrastructure, per se, I just don't think it's realistic to expect this kind of stuff to have much of an immediate impact on our lives.

Required code to post a link - [url=http://www.link.com]link[/url OMIT]

Required code to post an image - [img OMIT]http://www.image.com/image.jpg[/img]

(it's listed just below this window)

If your image is larger than 400px wide, add "width=400" after the url, like this:

Thanks, I'm trying to learn to post images, in the meantime here is the article, if someone wants to post the graph, I think it is very telling to as why this downturn is different.

Yes, I was around for both '90 and '01 recessions in NYC.

Unfortunately I do not have to tell you that we as architects have been much more vulnerable to this downturn.

I'm seeing some figures at around 8.4 mil jobs lost for this whole escapade, I will not get into debating those figures, that's another thread for another day. I do think it's curious that the official unemployment rate nationally has never broken the important psychological barrier of 10%, just an observation.

So, some simple math brings us to 350,000 jobs needed to be created each month for the next two years to get us back to where we were. That is not accounting for the new folks entering the workforce, which I've read is + - 100,000 per month.

This is why I shake my head when I talk to architects (and other professionals) who believe "it is coming back".

I guess the question then is "from where". Many folks are pointing to the "clean tech" field. I hope so, but that above job creation number is a pretty big nut to crack.

Unfortunately, my view is that we have experienced a paradigm shift in America (a violent one at that), and this state of affairs is pretty much it moving forward. I think that chart above will simply continue moving horizontally for the next 10 years or so.

I think we are living in a time of "back to basics"

C.K. good observation. I think that is illustrating our country's financial health. Just like when you have a cold, if you are healthy, you will bounce back quickly. If you are weak, it will take you much longer to recover.

I think painting the picture of this recession at the national level is important, but I think everyone knows how bad it is out there. These statistics cover a wide range of sectors and industries, but what I am personally concerned about is the 39,000 architecture jobs that were lost, and how this situation will impact our immediate community as architects.

The national debt is a big part of it, but I think this video is a better explanation of the root of the problem. It does well to explain complex concepts with cool infographics

Regarding the talk of a second wave of commercial foreclosures, there has been expert commentary that this wave would have been felt already or will only be felt at the corporate level, meaning there will be more mergers and such, but will not be felt on the street. The expert is Alan Greenspan, and he speaks about the former point in a recent interview. I understand he is no longer the most trusted man on the economy, but he is the smartest guy in the room.

All I know is that I have invested 200,000 grand in my architectural education and at this point in my life I can't really imagine doing anything else.

I am working now, luckily, BUT in China and recently I have met flocks of foreigners that are seeking shelter from this architectural downturn in Asia. If you are an unemployed architect with no attachments and a high threshold for Communism I suggest moving to China to ride out this recession. That said though, I actually can't wait to get out of here... it is pretty much like the closest thing to hell I have experienced.

So now I face the choice of returning to the US, where I will not get unemplyment because I haven't worked in the US since I attained my Masters (which is something that I think needs to be addressed in the unemployment dilemma). So I can either A) Change my career B) Kill myself C) Spend a couple more summers at the lake hoping that it comes back in the US while eating bread and butter OR D) Stay in F-ing China... Personally I think they are all horrible choices.

So I choose to remain optimistic that maybe I will have to serve a years sentence in China and then by 2011 I can land a job in the US/UK with my newly acquired international experience.

I think the best choice is to remain optimistic... without optimism what else do you have? nada.

Dot, thanks for the post, I guess my point is that we are in a profession which is very dependent on the overall "state of affairs" of the country. If all these parts are not working properly, together, no one is going to finance and build projects.

I am one of the casualties of the 39,000, all I can say is that w/ 20 years under my belt, BARCH, MARCH, licensed in 3 states, I am redefining myself in other areas. I have acquired a great skill set from architecture, and I am applying it in related fields.

1327, very interesting w/ the China story, maybe you could start a thread telling us what's it like in China, I've never been, very curious.

Sadly, I believe the profession of architecture is becoming a "commodity" and that is not going to be a good moving forward, especially for those entering the field.

“The Optimist expects the wind. The pessimist complains about the wind. The realist adjusts the sails.”

The line went up fast after 81 but thats factoring in the national employment numbers. If you lived between NJ and Minnesota the economy dove much deeper and took much longer to recover, if it even did in a lot of places like Gary, Flint, Detroit and Youngstown. They never recovered after '81.

Gibson said - "Unfortunately, my view is that we have experienced a paradigm shift in America (a violent one at that), and this state of affairs is pretty much it moving forward. I think that chart above will simply continue moving horizontally for the next 10 years or so"

Gibson I fear you are correct, that line is going to go more or less horizontal for a lot of the country. The economic rot started from the bottom up. First the farmers and commodity producers, then the industrial commodities like steel producers, then the major manufactures and users of the commodities like the auto industry, then it jumped into specialty manufacturers like televisions and electronics by the late 80s. During the 90s it became middle management and corporate downsizing of the service sector and finally the rot is spreading into the upper level economic functions once thought to be immune. People in the rust belt have been warning that something is afoul in the economy or maybe the world for 40 years now, and it seems it cant be ignored much longer.

Alan Greenspan is the smartest guy in which room? This is the guy who didn't think the mortgage bubble would ever "reach the street."

Commerical foreclosures will, and are already starting, to have an affect on us. It takes a few years for commercial leases to expire and as they do, office space will continue to be cheap and available... so no need to build more, right? That affects us.

China, India, Brazil... I wouldn't shy away from taking a look at these places if you can afford the initial cost of moving or have connections there.

It's all really depressing. This recession is a terrible thing, to be sure.

Yea, Greenspan......interesting fact, he used to be a jazz musician and part of Ann Rand's inner circle....too bad he did not stick w/ the music career.

2010 Economic Forecast - for Architects

According to the AIA, prior to 2008, there were 230,000 people employed in the architecture industry in the US. Between the collapse of 2008 and October of 2009, 39,000 people lost their job (17%). I couldn't find numbers since October, but gauging from word of mouth and job postings, I would be surprised if that number is above 20% today...so that's where we are right now.

According to the AIA construction spending survey released last month, construction spending in 2010 will decline by 13% in 2010 (for non-residential building), and grow 2% in 2011, modest, but a significant uptick from the previous year. The bad news is construction spending is still declining as indicated by the average architectural billing index last summer stagnating around 40 (50 is the break even number)

The good news is we should expect to see an increase in Architectural Billing in the next few months since the billing index (ABI) leads construction spending by 9-12 months. So in other words, the clients for the 2% in 2011 should be chatting with architects right about now.

I also read somewhere that residential remodeling should be strong compared to other sectors in the construction spending report, so there is hope for the small guys too.

I don't want to sound overly optimistic, but these are the macro numbers as they are which provide a small glimmer of hope...so keep your ear to the ground and keep your nose to the grindstone kids!

Sources:

Construction Spending (Jan 2010)

http://www.aia.org/press/releases/AIAB082023

Architectural Billing Index (ABI)

http://www.archpaper.com/e-board_rev.asp?News_ID=3609

Forecast is very cloudy and no chance of Rain. The "cloud seeding" that has taken place by the government the past 1 1/2 year is not helping.

So what your telling me is that those few jobs that I was told MIGHT happen actually WILL happen. Yay.

And Yay for optimism. Long time no see.

I intentionally left national economic trends out, but the architecture industry seems to be on par with GDP projections for the country (slow growth) Just saying to look at the numbers before pulling out the bottle of whiskey.

Optimism is unhealthy.

positive, not optimistic. there's a difference.

how bad will depend on where you are. Many municipalities have embraced "buy local" doctrines on hiring consultants. Texas and Colorado are doing alright. California and the northwest will have an odd combination of continuing misery and some bright spots. The Northeast is still somethng of an enigma. I have no idea what's going on in Dixie. People should flee Florida. Just run for dear life.

“The Optimist expects the wind. The pessimist complains about the wind. The realist adjusts the sails.”

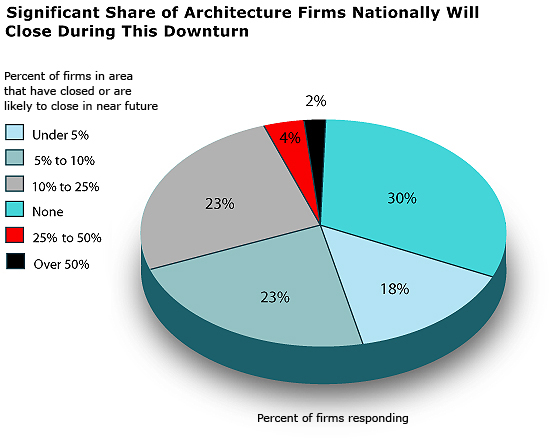

Thought the following chart from the latest AIA Work on the Boards report was interesting (albeit a bit confusing at first glance):

(Apologies for the cropped image, but you get the idea...)

Link to full Work on the Boards report here.

30% of firms are reporting that at least 10% of firms in their area have closed or are likely to close due to the recession. Would be curious to see how close the perception of respondents is to reality once the recession eventually ends.... are firm owners too optimistic or pessimistic about their competitors' survival prospects?

gresham - that graph is pretty sobering. I know of several firms that have ate the fish in this downturn, but all of them being smaller ones. Also know of some larger firms that have got gobbled up by even bigger ones. I think the only thing we know for sure is that the landscape of arch firms will be forever changed.

I like to be optimistic but more and more I have serious doubts we'll ever go back to business as usual circa 2007. Long term clients have told me straight up they will "never" do expansion like they did throughout most of the mid-2000's. Thus, the co-workers that were let go will probably never be rehired.

Right now everyone seems eager to celebrate the small victories, and that's fine. A lot of people need every bit of confidence they can find. Then again, if we aren't going back to BAU, at least in our lifetimes, when are we going to start having a serious discussion about seriously downsizing this profession?

The private sector has been doing the downsizing on their own, with harsh realities for those affected, i.e. all of us in one way or another. But academia still seems quite content to graduate swarms of new labor into the field each year. Obviously a downright terrifying job sector isn't scaring off students as they probably blindly believe we'll be going gangbusters again after the several years they spend studying. Maybe hiring managers at large firms should be speaking at Into Arch classes around the country.

aqua,

I would argue that 2007 was hardly business as usual. It was the tail end of a bubble of unsustainable growth, and shouldn't be held as a benchmark for the coming years. I think a broader look at the industry would help us manage expectations.

Secondly, I don't think it's just about job seekers maintaining confidence, but also employers having the confidence to project growth instead of constantly worrying about diminishing fees. These projections enable employers to consider long term employees, in whatever limited amount, for the first time in over 2 years.

sobering but not that bad, considering that the average architecture firm has around 10 employees - qualifying them as a small business. The run-rate, annual closure rate of small businesses in the US during a NORMAL economy is 4-6%, and now closer to 15-20%, in the recession. So if 6% say that over 25% of the firms in their area with close now or in the near future (which I'm reading as within one year) that's actually not that bad of a national weighted average.

Heck, there may even be 6% of practitioners surveyed coming from Florida, where there is a mini-architectural armageddon going on (I think the Miami Herald reported 70%+ unemployment among the state's architects last October).

Whoa, %70 unemployment for architects in FL? That's a total meltdown...

Depends on who you read or listen to, but I don't see any positive movements in the market. Tiny glimmers of hope, but not one thing I would call 'real'.

Doom and gloom (be forewarned)

It boils down to jobs and consumer confidence... I think as far as architecture firms goes, this year at least can't be as bad as last year... Hopefully say around April, as firms have started their new fiscal years, they may have some new projects or prospects and may return to hiring mode...? The way I see it, we need to wait this thing out... Eventually, with so many firms having contracted and some left the market... Once projects return, there should be a return in demand for architects...

I want to be optimistic about 2010, but I'm generally a glass half full... Find your way to get through, and eventually it will come back... This is the nature of a cyclical industry... Every recession you will get those who cannot take the swings and may leave, and others who find better careers in other industries...

I agree that when things move forward again, and eventually there will, those firms ready to ramp up will prosper. That's also the nature of cycles - those prepared will reap the rewards.

I pray that we'll all be caught off guard on how fast things shift, as they tend to move faster than can be anticipated. When that happens, who knows.

I also pray that article I posted is wrong. If it is right, then we better buy some guns, water, food and booze and head to the mtns. :-/

trace,

my instincts tell me not to trust a guy in a pink shirt, but i'll bite. going back to the construction spending survey, the commercial building sector is projected to grow the most from -18% in 2010 to +10% in 2011, and since these numbers lag activity in this sector, we may be witnessing a small bubble in commercial development. if we're taking the long view on this, this year may just be a minor up tick in a very slow recovery.

Various points here

1) Construction Labor Market

About 25% of the construction labor market is unemployed. This means that people who make construction happen are more than likely short on cash and credit. It will be difficult to motivate these people back into their jobs.

AS far as this is concerned, this will greatly affect mobility-- meaning that you shouldn't be surprised if relocation expenses are itemized on your contractors statements.

For areas like Florida, Arizona and California... there might actually be labor shortages in areas due to construction workers chasing stimulus projects.

2) Commercial real estate markets

While defaults on residential mortgages are stagnating, CRE (commercial real estate) defaults are on the rise.

Real Estate Econometrics put the figure at 4% in December with an increase of about a 1% increase per month over the next year.

This has good news written on it though. As figures scare major real estate investment firms, these firms will start to liquidate long-term lease land and existing properties.

3) Construction Material Cool Down

With the exception of copper and wood, material prices are plummeting.

Steel is down something like 12% and concrete is down 8%. If trends continue downward, investors will start considering building again. This means in the short term there will be land acquisitions, planning, documentation et cetera to get projects started enough so that materials can be bought and prices locked in.

4) Delays and non-support

There is a nationwide trend going on in municipalities where entire local governments are essentially shitting down, cutting their staff and maintaining only minimal services.

This could be especially challenging if you're building bigger projects as there will no longer be planners and economic development types securing you credit, tax cuts, fast track permitting or zoning changes.

Be wary because the hand holding might be gone!

architorture never ends, either employed or unemployed!

mont - lumber is up something like 25% percent in the last 2 months.

dot - the article goes into pretty detailed descriptions of how the smaller banks are going to get hit hard, soon, and the wave it'll cause.

Not the first time I've heard this. Many think the second leg down in this mess will make the first one look like a dance in the park.

I can't see how anything will be going up for a long time, not in commercial.

I do know of people buying distressed assets, but that's a different beast (needed, though, to 'mop' up the debris from this mess).

I'm curious: of those of us who are making predictions, how many of us have actually seen several recessions before and experienced more than one other downturn and lived on to tell the tale? It seems to me that most of the people Ive talked to who have been around for a long time and seen recessions come and go are less likely to panic, generally mire used to the cyclical reality of our industry? Is this recession really that different from all others which have come before?

I did say with the exception of copper and wood.

I think one of the larger issues here is a three part issue.

Depreciation calculation methodology will almost certainly always favor certain land and building uses over others.

For Mixed-Use, Rental and Commercial... the depreciation timeline is 39 years. For most other properties, it is 29 years.

This means it is harder to recoup the costs in the short term, favors smaller loan periods and gives no incentive to build more complex, bigger and or permanent buildings.

This is compounded even further that the maximum allowable write off for depreciation is $250,000 dollars per deduction no. 179 regulation. So, if we do an ass backwards calculation... there is no incentive to build buildings with values of more than $10,000,000.

There's also no incentive in replacing appliances and other capital goods for this reason.

Lastly, commercial real estate prices (and by extension, residential high-rises) are entirely way overpriced.

If we take the Burj Whatever-it-is... with all of it's bells and whistles... averages $300 per square foot.

That comes out to something like less than $50 per square foot (at cost) annually in rent. There are offices in Manhattan that don't have massive leaking shark tanks in them or are 3,000 feet tall that rent for higher than that.

And street level retail space? Are you kidding me? How the hell does anyone afford rent?

The fact of the matter is that most of this stuff is wayyyyyyy over priced.

Not even people making good money can afford $200,000 in annual rent for a 2000 square foot retail space. Even if you were say spending 50% of your expenses on rent, you'd have to sell 10 t-shirts per square foot to stay in business!

That's 109 shirts a day!

trace - the only game in commercial right now is 'build to suit'. which means you better have a solid relationship with the developer or agent representing the client. or the client themselves.

silver lining is that those deals seem to be much more 'solid' financially than all the spec work - much less chance of getting hung out to dry on the fees.

The only reason non-residential construction might be in the plus 2% range for 2011 is horizontal construction. Vertical construction is expected to decline for 2011 as well. I don't know to many architectural firms that participate in road design. This is probably why you are not getting the meetings with these potential clients. Construction materials have held steady or increased. The idea that prices have plummeted is a myth. The only thing that makes it a good time to build right now is the undercutting of your competition that is resulting in GC's bidding projects at cost and below cost planning on change ordering their way into the black. The commercial real estate market is primed to fall straight off a cliff. Anyone who is considering building right now must have the tenants lined up and under contract. Shortly their will be many newly built CRE properties available at fire sale prices.

Panic does no one any good, but better to be prepared.

well said, montagneux. You just concisely summed up what I've been saying to people for the last year with commercial contracts. Commercial real estate prices are still way overpriced and overbuilt and have nowhere to go but down.

Anyone see that new home sales hit an all-time low today? An article in Bloomberg today pointed out that home prices in much of the country are still above where they should be when we take into account historical price trends.

I agree with much of Trace's posted article, with the caveat that it's still too much doom & gloom.

1. We've got a government that's passed some legislation to help out with credit card defaults.

2. I think housing prices could either drop a little more or stabilize. There won't be price growth for another 3-5 years and when there is, it will be anemic. They can either drop below historical trends and then begin another ascent or continue to muddle-through. I see the latter as being more likely.

3. While banks are still undercapitalized and would be pretty screwed if all their commercial lending fell through, they have been capitalizing rapidly. The larger banks have been shored up via Obama's printing presses. With the passage of healthcare and a slew of other bills, if the democrats are able to stay popular, or if the tea-baggers split the conservative vote, we'll have a powerful government that can work through this stuff. While I realize there's a lot of corruption going on here, the alternative of a stalled government and massive bank failures would really make it time to get out the guns and move to the country.

4. More businesses will walk away, but it's not an all or nothing situation. There will be negotiations and deals will be brokered. I just saw this happen recently with a job. The developer / owner didn't think he'd be able to find someone to lease the new property. Eventually, they did find someone and negotiated a deal where the developer's profit margin is really, really low (for how much risk they took) but which does allow them to make a small profit and keep afloat for the next 10 years.

5. That fifth point about the end of government bought mortgage backed securities does worry me a lot. Not sure how that's going to be handled. But again, the printing presses and flexibility of a strong government are available.

I'm not saying that any of this is "good", just that I think there's a better possibility that we muddle-through for the next three-four years.

At the end, the author questions where the new jobs will come from. People asked similar questions before the mid-90s & during the mid-80s. There's really no way to predict where the next wave of innovation will come from, or if it will come at all. There are a lot of elements of chance and luck here. It could be something sexy like biotech or green technologies, or it could be something less interesting like resurgent manufacturing due to a revaluation of the Yuen.

In the meantime, we shouldn't count on federal stimulus for massive infrastructure projects. The money is meant to go for projects already in the pipeline or for small fixes. This is smart, politically. New, large developments in the cities of the US take decades to get the ball rolling, mobilize NIMBYS, are always way over budget, and are already too small or redundant once completed. We should focus on creating small changes in our communities that utilize what we already have.

For instance, I was talking to my friend the other day, who works for a planning department in a small coastal town. The department is all in a tizzy over a plan proposed by some students to build a freeway cap that would connect the city to the beach with the goal of bringing more people down to the water (it's a great surf spot).

While I like the formal idea of freeway caps, the problem with the scheme is that it would cost a cool 200 billion to get built (and probably end up being twice that when all is said and done). On top of that, you've got different jurisdictions governing the right of ways over the freeway.

Meanwhile, down the road, you've got an existing bridge that looks kinda old and isn't used by anyone.

The idea he proposed to his bosses was to take their existing fleet of old busses, many of which aren't used, and fix them up with a couple million of stimulus funds and call them party buses. Set up a website to make it cool. Slap some paint on the old bridge and have community events down near the water. Maybe splurge and build a cool pavilion but focus more money on creating a program that works to make these events fun.

To me, in the short-term, it makes more sense to spend a couple million on something like this, instead of 200 billion (probably more) on something massive that will end up annoying people during it's 5-10 years of construction.

Sorry for the long post and I'll probably end up being wrong in most of my predictions. I'm not against large infrastructure, per se, I just don't think it's realistic to expect this kind of stuff to have much of an immediate impact on our lives.

head almost above water...

http://archrecord.construction.com/community/blogs/NotebookBlog.asp?plckController=Blog&plckBlogPage=BlogViewPost&newspaperUserId=66e68286-26bb-4c58-9c54-29d3c8e54bcb&plckPostId=Blog:66e68286-26bb-4c58-9c54-29d3c8e54bcbPost:bbf5c268-3516-4b9f-8ff3-e766efce46f9&plckScript=blogScript&plckElementId=blogDest

bRink, to answer your question, from my perspective (20 years), yes, this "recession" is significantly different from previous downturns.

I've got a chart on employment which is pretty telling, but I have not figured out how to post here, any help?

Required code to post a link - [url=http://www.link.com]link[/url OMIT]

Required code to post an image - [img OMIT]http://www.image.com/image.jpg[/img]

(it's listed just below this window)

If your image is larger than 400px wide, add "width=400" after the url, like this:

[img OMIT]http://www.image.com/image.jpg width=400[/img]

Delete the word OMIT, I put that there so it would show the code

ohhh that makes better quote text though!

Thanks, I'm trying to learn to post images, in the meantime here is the article, if someone wants to post the graph, I think it is very telling to as why this downturn is different.

http://www.huffingtonpost.com/2009/02/06/job-loss-chart-what-36-mi_n_164828.html

how low can you go! how low can you go!

yeah, I knew I had seen this before.

This article is more than a year old. I wonder how the graph looks now.

and here we go:

looks like it was pretty bad in '81 but the line went up much faster than in '90 and '01.

Yes, I was around for both '90 and '01 recessions in NYC.

Unfortunately I do not have to tell you that we as architects have been much more vulnerable to this downturn.

I'm seeing some figures at around 8.4 mil jobs lost for this whole escapade, I will not get into debating those figures, that's another thread for another day. I do think it's curious that the official unemployment rate nationally has never broken the important psychological barrier of 10%, just an observation.

So, some simple math brings us to 350,000 jobs needed to be created each month for the next two years to get us back to where we were. That is not accounting for the new folks entering the workforce, which I've read is + - 100,000 per month.

This is why I shake my head when I talk to architects (and other professionals) who believe "it is coming back".

I guess the question then is "from where". Many folks are pointing to the "clean tech" field. I hope so, but that above job creation number is a pretty big nut to crack.

Unfortunately, my view is that we have experienced a paradigm shift in America (a violent one at that), and this state of affairs is pretty much it moving forward. I think that chart above will simply continue moving horizontally for the next 10 years or so.

I think we are living in a time of "back to basics"

C.K. good observation. I think that is illustrating our country's financial health. Just like when you have a cold, if you are healthy, you will bounce back quickly. If you are weak, it will take you much longer to recover.

Here is a good overview of why, in my opinion at least:

http://www.iousathemovie.com/

I think painting the picture of this recession at the national level is important, but I think everyone knows how bad it is out there. These statistics cover a wide range of sectors and industries, but what I am personally concerned about is the 39,000 architecture jobs that were lost, and how this situation will impact our immediate community as architects.

The national debt is a big part of it, but I think this video is a better explanation of the root of the problem. It does well to explain complex concepts with cool infographics

http://vimeo.com/3261363

Regarding the talk of a second wave of commercial foreclosures, there has been expert commentary that this wave would have been felt already or will only be felt at the corporate level, meaning there will be more mergers and such, but will not be felt on the street. The expert is Alan Greenspan, and he speaks about the former point in a recent interview. I understand he is no longer the most trusted man on the economy, but he is the smartest guy in the room.

All I know is that I have invested 200,000 grand in my architectural education and at this point in my life I can't really imagine doing anything else.

I am working now, luckily, BUT in China and recently I have met flocks of foreigners that are seeking shelter from this architectural downturn in Asia. If you are an unemployed architect with no attachments and a high threshold for Communism I suggest moving to China to ride out this recession. That said though, I actually can't wait to get out of here... it is pretty much like the closest thing to hell I have experienced.

So now I face the choice of returning to the US, where I will not get unemplyment because I haven't worked in the US since I attained my Masters (which is something that I think needs to be addressed in the unemployment dilemma). So I can either A) Change my career B) Kill myself C) Spend a couple more summers at the lake hoping that it comes back in the US while eating bread and butter OR D) Stay in F-ing China... Personally I think they are all horrible choices.

So I choose to remain optimistic that maybe I will have to serve a years sentence in China and then by 2011 I can land a job in the US/UK with my newly acquired international experience.

I think the best choice is to remain optimistic... without optimism what else do you have? nada.

Dot, thanks for the post, I guess my point is that we are in a profession which is very dependent on the overall "state of affairs" of the country. If all these parts are not working properly, together, no one is going to finance and build projects.

I am one of the casualties of the 39,000, all I can say is that w/ 20 years under my belt, BARCH, MARCH, licensed in 3 states, I am redefining myself in other areas. I have acquired a great skill set from architecture, and I am applying it in related fields.

1327, very interesting w/ the China story, maybe you could start a thread telling us what's it like in China, I've never been, very curious.

Sadly, I believe the profession of architecture is becoming a "commodity" and that is not going to be a good moving forward, especially for those entering the field.

“The Optimist expects the wind. The pessimist complains about the wind. The realist adjusts the sails.”

CK,

The line went up fast after 81 but thats factoring in the national employment numbers. If you lived between NJ and Minnesota the economy dove much deeper and took much longer to recover, if it even did in a lot of places like Gary, Flint, Detroit and Youngstown. They never recovered after '81.

Gibson said - "Unfortunately, my view is that we have experienced a paradigm shift in America (a violent one at that), and this state of affairs is pretty much it moving forward. I think that chart above will simply continue moving horizontally for the next 10 years or so"

Gibson I fear you are correct, that line is going to go more or less horizontal for a lot of the country. The economic rot started from the bottom up. First the farmers and commodity producers, then the industrial commodities like steel producers, then the major manufactures and users of the commodities like the auto industry, then it jumped into specialty manufacturers like televisions and electronics by the late 80s. During the 90s it became middle management and corporate downsizing of the service sector and finally the rot is spreading into the upper level economic functions once thought to be immune. People in the rust belt have been warning that something is afoul in the economy or maybe the world for 40 years now, and it seems it cant be ignored much longer.

I'm really hoping it doesn't come down to moving to China.

2step, thanks, I fear I am correct also.

Yea, rather ironic that the immediate employment opportunities are in China....

Alan Greenspan is the smartest guy in which room? This is the guy who didn't think the mortgage bubble would ever "reach the street."

Commerical foreclosures will, and are already starting, to have an affect on us. It takes a few years for commercial leases to expire and as they do, office space will continue to be cheap and available... so no need to build more, right? That affects us.

China, India, Brazil... I wouldn't shy away from taking a look at these places if you can afford the initial cost of moving or have connections there.

It's all really depressing. This recession is a terrible thing, to be sure.

Yea, Greenspan......interesting fact, he used to be a jazz musician and part of Ann Rand's inner circle....too bad he did not stick w/ the music career.

I just saw an interview w/ these two:

http://baselinescenario.com/

I think they are right on target about what happened, and where we are, and more importantly the real forces at work here.

We as citizens should be outraged and very vocal about the state of affairs the "oligarchs" have put us in. It affects everyone.

All I know is the more I learn and understand what happened, the more outraged I become.

Block this user

Are you sure you want to block this user and hide all related comments throughout the site?

Archinect

This is your first comment on Archinect. Your comment will be visible once approved.